- Market services

- Indigenous advisory

-

Compliance audits & reviews

Our audit team undertakes the complete range of audits required of Australian accounting laws to help you to help you meet obligations or fulfil best practice procedures.

-

Audit quality

We are fiercely dedicated to quality, use proven and globally tested audit methodologies, and invest in technology and innovation.

-

Financial reporting advisory

Our financial reporting advisory team helps you understand changes in accounting standards, develop strategies and communicate with your stakeholders.

-

Audit advisory

Grant Thornton’s audit advisory team works alongside our clients, providing a full range of reviews and audits required of your business.

-

Corporate tax & advisory

We provide comprehensive corporate tax and advisory service across the full spectrum of the corporate tax process.

-

Private business tax & advisory

We work with private businesses and their leaders on all their business tax and advisory needs.

-

Tax compliance

We work alongside clients to manage all tax compliance needs and identify potential compliance or tax risk issues.

-

Employment tax

We help clients understand and address their employment tax obligations to ensure compliance and optimal tax positioning for their business and employees.

-

International tax

We understand what it means to manage tax issues across multiple jurisdictions, and create effective strategies to address complex challenges.

-

GST, stamp duty & indirect tax

Our deep technical knowledge and practical experience means we can help you manage and minimise the impact of GST and indirect tax, like stamp duty.

-

Tax law

Our team – which includes tax lawyers – helps you understand and implement regulatory requirements for your business.

-

Innovation Incentives

Our national team has extensive experience navigating all aspects of the government grants and research and development tax incentives.

-

Transfer pricing

Transfer pricing is one of the most challenging tax issues. We help clients with all their transfer pricing requirements.

-

Tax digital consulting

We analyse high-volume and unstructured data from multiple sources from our clients to give them actionable insights for complex business problems.

-

Corporate simplification

We provide corporate simplification and managed wind-down advice to help streamline and further improve your business.

-

Superannuation and SMSF

Increasingly, Australians are seeing the benefits, advantages and flexibility of taking control of their own superannuation and retirement planning.

-

Payroll consulting & Award compliance

Many organisations are grappling with a myriad of employee agreements and obligations, resulting in a wide variety of payments to their people.

-

Cyber resilience

The spectrum of cyber risks and threats is now so significant that simply addressing cybersecurity on its own isn’t enough.

-

Internal audit

We provide independent oversight and review of your organisation's control environments to manage key risks, inform good decision-making and improve performance.

-

Financial crime

Our team helps clients navigate and meet their obligations to mitigate crime as well as develop and implement their risk management strategies.

-

Consumer Data Right

Consumer Data Right (CDR) aims to provide Australians with more control over how their data is used and disclosed.

-

Risk management

We enable our clients to achieve their strategic objectives, fulfil their purpose and live their values supported by effective and appropriate risk management.

-

Controls assurance

In Australia, as with other developed economies, regulatory and market expectations regarding corporate transparency continue to increase.

-

Governance

Through fit for purpose governance we enable our clients to make the appropriate decisions on a timely basis.

-

Regulatory compliance

We enable our clients to navigate and meet their regulatory and compliance obligations.

-

Forensic accounting and dispute advisory

Our team advises at all stages of a litigation dispute, taking an independent view while gathering and reviewing evidence and contributing to expert reports.

-

Investigations

Our licensed forensic investigators with domestic and international experience deliver high quality results in the jurisdictions in which you operate.

-

Digital forensics

Our digital forensic experts identify, preserve and analyse data in the context of reputation and regulatory enforcement issues for investigations, legal or administrative proceedings.

-

eDiscovery

In a data-driven economy, data enables commercial and economic growth, innovation, and social benefit.

-

Asset tracing investigations

Our team of specialist forensic accountants and investigators have extensive experience in tracing assets and the flow of funds.

-

Mergers and acquisitions

Our mergers and acquisitions specialists guide you through the whole process to get the deal done and lay the groundwork for long-term success.

-

Acquisition search & strategy

We help clients identify, finance, perform due diligence and execute acquisitions to maximise the growth opportunities of your business.

-

Selling a business

Our M&A team works with clients to achieve a full or partial sale of their business, to ensure achievement of strategic ambitions and optimal outcomes for stakeholders.

-

Operational deal services

Our operational deal services team helps to ensure the greatest possible outcome and value is gained through post merger integration or post acquisition integration.

-

Transaction advisory

Our transaction advisory services support our clients to make informed investment decisions through robust financial due diligence.

-

Business valuations

We use our expertise and unique and in-depth methodology to undertake business valuations to help clients meet strategic goals.

-

Tax in mergers & acquisition

We provide expert advice for all M&A taxation aspects to ensure you meet all obligations and are optimally positioned.

-

Corporate finance

We provide effective and strategic corporate finance services across all stages of investments and transactions so clients can better manage costs and maximise returns.

-

Debt advisory

We work closely with clients and lenders to provide holistic debt advisory services so you can raise or manage existing debt to meet your strategic goals.

-

Working capital optimisation

Our proven methodology identifies opportunities to improve your processes and optimise working capital, and we work with to implement changes and monitor their effectiveness.

-

Capital markets

Our team has significant experience in capital markets and helps across every phase of the IPO process.

-

Debt and project finance raising

Backed by our experience accessing full range of available funding types, we work with clients to develop and implement capital raising strategies.

-

Private equity

We provide advice in accessing private equity capital.

-

Financial modelling

Our financial modelling advisory team provides strategic, economic, financial and valuation advice for project types and sizes.

-

Payments advisory

We provide merchants-focused payments advice on all aspects of payment processes and technologies.

-

Voluntary administration & DOCA

We help businesses considering or in voluntary administration to achieve best possible outcomes.

-

Corporate insolvency & liquidation

We help clients facing corporate insolvency to undertake the liquidation process to achieve a fair and orderly company wind up.

-

Complex and international insolvency

As corporate finance specialists, Grant Thornton can help you with raising equity, listings, corporate structuring and compliance.

-

Safe Harbour advisory

Our Safe Harbour Advisory helps directors address requirements for Safe Harbour protection and business turnaround.

-

Bankruptcy and personal insolvency

We help clients make informed choices around bankruptcy and personal insolvency to ensure the best personal and stakeholder outcome.

-

Creditor advisory services

Our credit advisory services team works provides clients with credit management assistance and credit advice to recapture otherwise lost value.

-

Small business restructuring process

We provide expert advice and guidance for businesses that may need to enter or are currently in small business restructuring process.

-

Asset tracing investigations

Our team of specialist forensic accountants and investigators have extensive experience in tracing assets and the flow of funds.

-

Independent business reviews

Does your company need a health check? Grant Thornton’s expert team can help you get to the heart of your issues to drive sustainable growth.

-

Commercial performance

We help clients improve commercial performance, profitability and address challenges after internal or external triggers require a major business model shift.

-

Safe Harbour advisory

Our Safe Harbour advisory helps directors address requirements for Safe Harbour protection and business turnaround.

-

Corporate simplification

We provide corporate simplification and managed wind-down advice to help streamline and further improve your business.

-

Director advisory services

We provide strategic director advisory services in times of business distress to help directors navigate issues and protect their company and themselves from liability.

-

Debt advisory

We work closely with clients and lenders to provide holistic debt advisory services so you can raise or manage existing debt to meet your strategic goals.

-

Business planning & strategy

Our clients can access business planning and strategy advice through our value add business strategy sessions.

-

Private business company secretarial services

We provide company secretarial services and expert advice for private businesses on all company secretarial matters.

-

Outsourced accounting services

We act as a third-party partner to international businesses looking to invest in Australia on your day-to-day finance and accounting needs.

-

Superannuation and SMSF

We provide SMSF advisory services across all aspects of superannuation and associated tax laws to help you protect and grow your wealth.

-

Management reporting

We help you build comprehensive management reporting so that you have key insights as your business grows and changes.

-

Financial reporting

We help with all financial reporting needs, including set up, scaling up, spotting issues and improving efficiency.

-

Forecasting & budgeting

We help you build and maintain a business forecasting and budgeting model for ongoing insights about your business.

-

ATO audit support

Our team of experts provide ATO audit support across the whole process to ensure ATO requirements are met.

-

Family business consulting

Our family business consulting team works with family businesses on running their businesses for continued future success.

-

Private business taxation and structuring

We help private business leaders efficiently structure their organisation for optimal operation and tax compliance.

-

Outsourced CFO services

Our outsourced CFO services provide a full suite of CFO, tax and finance services and advice to help clients manage risk, optimise operations and grow.

-

ESG & sustainability reporting

There is a growing demand for organisations to provide transparency on their commitment to sustainability and disclosure of the nonfinancial impacts of their business activities. Commonly, the responsibility for sustainability and ESG reporting is landing with CFOs and finance teams, requiring a reassessment of a range of reporting processes and controls.

-

ESG & sustainability advisory

With the ESG and sustainability landscape continuing to evolve, we are focussed on helping your business to understand what ESG and sustainability represents and the opportunities and challenges it can provide.

-

Management consulting

Our management consulting services team helps you to plan and implement the right strategy to deliver sustainable growth.

-

Financial consulting

We provide financial consulting services to keep your business running so you focus on your clients and reaching strategic goals.

-

China practice

The investment opportunities between Australia and China are well established yet, in recent years, have also diversified.

-

Japan practice

The trading partnership between Japan and Australia is long-standing and increasingly important to both countries’ economies.

-

India practice

It’s an exciting time for Indian and Australian businesses looking to each jurisdiction as part of their growth ambitions.

-

Singapore practice

Our Singapore Practice works alongside Singaporean companies to achieve growth through investment and market expansion into Australia.

-

Insight Identify your opportunities in the complex landscape of fuel tax creditsThe landscape of fuel tax credits (FTC) is constantly evolving due to ongoing economic and technological developments. This dynamic environment presents both challenges and opportunities for businesses with significant fuel consumption.

Insight Identify your opportunities in the complex landscape of fuel tax creditsThe landscape of fuel tax credits (FTC) is constantly evolving due to ongoing economic and technological developments. This dynamic environment presents both challenges and opportunities for businesses with significant fuel consumption. -

Client Alert March 2024 Update: NSW Grants for Net Zero Manufacturing and Physical SciencesSome major NSW grant programs have been announced, supporting projects in clean technology innovation, low carbon product manufacturing, renewable manufacturing and physical sciences.

Client Alert March 2024 Update: NSW Grants for Net Zero Manufacturing and Physical SciencesSome major NSW grant programs have been announced, supporting projects in clean technology innovation, low carbon product manufacturing, renewable manufacturing and physical sciences. -

Insight Navigating a complex Agribusiness, Food and Beverage deals landscape in 2024Despite a 14% global decline in Agribusiness, Food, and Beverage M&A deals, 2024 shows promise with expected global interest rate stabilisation. Given the sector's role in global sustainability, businesses can tap into opportunities in food manufacturing and waste minimisation.

Insight Navigating a complex Agribusiness, Food and Beverage deals landscape in 2024Despite a 14% global decline in Agribusiness, Food, and Beverage M&A deals, 2024 shows promise with expected global interest rate stabilisation. Given the sector's role in global sustainability, businesses can tap into opportunities in food manufacturing and waste minimisation. -

Client Alert Grants: February 2024Businesses should be aware of the numerous grant opportunities available from Commonwealth, State, and private sources. These grants could be the key to making manufacturing, agriculture, and green economy projects a reality.

Client Alert Grants: February 2024Businesses should be aware of the numerous grant opportunities available from Commonwealth, State, and private sources. These grants could be the key to making manufacturing, agriculture, and green economy projects a reality.

-

Renewable Energy

Transformation through energy transition

-

Business Planning and Strategy

Having an honest, broad-reaching and thought-provoking discussion with a skilled, independent advisor can be the catalyst for clarity – a direction to take your business forward and an understanding of what is key to success.

-

Flexibility & benefits

The compelling client experience we’re passionate about creating at Grant Thornton can only be achieved through our people. We’ll encourage you to influence how, when and where you work, and take control of your time.

-

Your career development

At Grant Thornton, we strive to create a culture of continuous learning and growth. Throughout every stage of your career, you’ll to be encouraged and supported to seize opportunities and reach your full potential.

-

Diversity & inclusion

To be able to reach your remarkable, we understand that you need to feel connected and respected as your authentic self – so we listen and strive for deeper understanding of what belonging means.

-

In the community

We’re passionate about making a difference in our communities. Through our sustainability and community engagement initiatives, we aim to contribute to society by creating lasting benefits that empower others to thrive.

-

Graduate opportunities

As a new graduate, we aim to provide you more than just your ‘traditional’ graduate program; instead we kick start your career as an Associate and support you to turn theory into practice.

-

Vacation program

Our vacation experience program will give you the opportunity to begin your career well before you finish your degree.

-

The application process

Applying is simple! Find out more about each stage of the recruitment process here.

-

FAQs

Got questions about applying? Explore frequently asked questions about our early careers programs.

-

Our services lines

Learn about our services at Grant Thornton

-

Current opportunities

Current opportunities

-

Remarkable people

Our team members share their remarkable career journeys and experiences of working at Grant Thornton.

-

Working at Grant Thornton

Explore our culture, benefits and ways we support you in your career.

-

Current opportunities

Positions available.

-

Contact us

Get in touch

The headline takeaways from the Budget are:

- Western Australia’s economy continues to grow, with Gross State Product expected to increase by 2% in 2018-19

- Growth in GDP is expected to accelerate to 3.5% in 2019-20, and 3% in 2020-21 onward, with further growth in exports and the domestic economy becoming the major driver of growth

- The Government is focussed and is on track to achieve its target to create an additional 150,000 jobs by 2023-24

- $4.1b investment in job-creating METRONET projects

- $4.2b investment in upgrades to roads, including more than $2b on building, upgrading and maintaining roads in regional WA

- More than $62.1m is set aside to fund the government’s two year action plan for tourism

- $182.4m for a new Employer Incentive Scheme and training delivery, including over $45m for regional WA

- $131.5m additional expenditure to support agriculture in WA, grow export markets and create long-term jobs

- Budget returns to general government operating surplus of $553m in 2018-19

- $1.5b forecast surplus in 2019-20, rising to over $2b from 2020-21 to 2022-23

- Revenue is estimated to total $31.3b in 2019-20, with 66% generated directly by the State

This Budget also supports households with the lowest increase in tariffs, fees and charges since 2006-07 (2%). In addition, spending aimed at improving the quality and sustainability of health care, education and community services is at record levels, highlighting the Government’s commitment to achieving its targets of a safer community, a bright future and promoting Aboriginal wellbeing.

The Budget should be viewed together with the revenue changes to Duties, Land Tax, Tax Administration and Pay-roll Tax which either passed through Parliament last week (Duties, Land Tax and Taxation Administration) or are still being debated (Pay-roll Tax).

Summary

For more information on the Western Australian State Budget 2019-20 and revenue changes, please read the below summaries:

Budget announcements

Specifically, the Budget delivers the following:

The state of the WA economy

- Western Australia’s economy continues to grow, with Gross State Product expected to increase by 2% in 2018-19.

- Growth in GSP is expected to accelerate to 3.5% in 2019-20, and 3% in 2020-21 onward, with further growth in exports and the domestic economy becoming the major driver of growth.

- The Government is focussed and is on track to achieve its target to create an additional 150,000 jobs by 2023-24.

Infrastructure

The Budget includes a record $4.1b investment in job-creating METRONET projects.

- $536m to build the Thornlie-Cockburn Link, with construction expected to start later this year

- $520m to build the Yanchep Rail extension, with construction expected to start later this year

- $146m to build the new Bayswater Station, the first stage of the Morley-Ellenbrook Line, with construction expected to start later this year

- $207.5m over the forward estimates to remove level crossings on the Armadale Line at Oats Street, Mint Street and Welshpool Road

- $1.2b allocation for projects in detailed planning stages, including the Byford Rail Extension, Morley, Ellenbrook Line, Midland Station Project and new Karnup Station

- The Budget includes a $4.2b investment in upgrades to roads, including more than $2b on building, upgrading and maintaining roads in regional WA.

- $1.2b for the Tonkin Highway Transformation Project

- $852m for the Bunbury Outer Ring Road

- $310m for the ongoing construction of Karratha-Tom Price Road

- $275m for Great Northern Highway - Bindoon Bypass

- $230m for the Fremantle Traffic Bridge replacement project

- $180m for the Great Eastern Highway Bypass grade separated interchanges at Roe Highway and Abernethy Road

- $175m for the Albany Ring Road

- $87.5m to upgrade Great Northern Highway from Broome to Kununurra

- $87.5m for Wheatbelt Secondary Freight Routes upgrades

- $40m for Coolgardie-Esperance Highway upgrades

- $27.5m for Stage One Pinjarra Heavy Haulage Deviation

Tourism

More than $62.1m is set aside to fund the government’s two year action plan for tourism.

- More than $22m for the creation and ongoing management of national parks, marine parks and conservation reserves

- $12m in new funding for international destination marketing

- $10m for international aviation development to secure more direct flights to Perth

- $10m for Collie Adventure Trails to turn Collie into WA’s premier adventure trail town, as part of the Industry Attraction and Development Fund

- $4.5m to implement the StudyPerth International Education Plan

- $3.6m to support Aboriginal Tourism Initiatives

Diversifying the economy

There is a focus on diversifying the economy, including;

- $182.4m for a new Employer Incentive Scheme and training delivery, including over $45m for regional WA

- $131.5m additional expenditure to support agriculture in WA, grow export markets and create long-term jobs

- $60.1m for the Collie Industry Attraction and Development Fund

- $52m towards the Future Health Research and Innovation Fund

- $48.4m to upgrade port facilities across WA

- An additional $19.5m for the Forrestdale Business Park

- $10m towards the new LNG Futures Facility

- $7m to build and operate a state-of-the-art marine finfish nursery facility in Geraldton

- $8m for a new multipurpose bushfire facility in Collie as part of the Collie Industry Attraction and Development Fund

State of the finances

- Budget returns to general government operating surplus of $553m in 2018-19

- $1.5b forecast surplus in 2019-20, rising to over $2b from 2020-21 to 2022-23

Revenue at a glance

Revenue is estimated to total $31.3b in 2019-20, with 66% generated directly by the State

Overview of Duties Amendments

The Revenue Laws Amendment Bill 2018 (WA) (“Bill”) had its second reading speech in the Legislative Council on 7 May 2019 is awaiting the 3rd and final reading. The Bill seeks to make changes to the Duties Act 2008 (WA) (“Amendments”).

The Amendments broadly seek to bring the operation of the Western Australian duties regime in line with the other States and Territories, which ultimately results in a broadening of the scope Western Australian duties and a tightening of the operation of exemptions. However, in doing so, the Amendments go further than other States and Territories particularly regarding the extended reach of landholder duty and the introduction of certain infrastructure and mining rights as “dutiable property” and “land”.

What this means for taxpayers is that the way in which transactions were implemented in the past may now have a very different duty profile, leading to a new or increased exposure to duty which would need to be modelled for future transactions.

We set out below some highlights and practical effect of the changes. It is not possible to address all of the impacts and nuances of the changes given how extensive they are. Rather, taxpayers should seek our advice on contemplated transactions to assist in navigating the changes and specific impact they have, with a view to implementing transactions with appropriate modelling of any duty leakage.

The Amendments commence the day after assent.

The Amendments seek to broaden the concept of “land” for the purposes of both transfer duty and landholder duty. However, the largest practical impact is expected to be in relation to landholder duty. Landholder duty applies to a 50% or more acquisition (or increased interest) of a company or unit trust which has an entitlement to “land” with a market value of $2m or more, with a top duty rate of 5.15% (plus an additional 7% if foreign landholder duty applies).

The Amendments extend the definition of “land” to include anything “fixed to land” (eg bolted or attached to a wall or floor by more than its own weight), which is more in line with the other States and Territories (except New South Wales and Australian Capital Territory). This change will now likely include property such as retail/office fitouts in determining whether the $2m threshold is met. Practically, this means that any relevant acquisition of a company or unit trust would need to be tested against the $2m landholder threshold to determine if landholder duty is payable. If the entity is a “landholder”, duty (and potentially foreign landholder duty) is not only charged on the value of “land”, but also certain goods located in Western Australia such as plant and equipment.

Historically, the concept of “fixed to land” has been confined to mining tenements, which has meant that taxpayers who have leasehold interests only (eg retail and office premises) have largely been outside the landholder duty base as they would not constitute a “landholder”.

The Amendments widen the circumstances where otherwise unrelated investors in a company or unit trust are treated as making the investment as one, thereby collectively acquiring 50% or more interest in a landholder and resulting in liability to landholder duty.

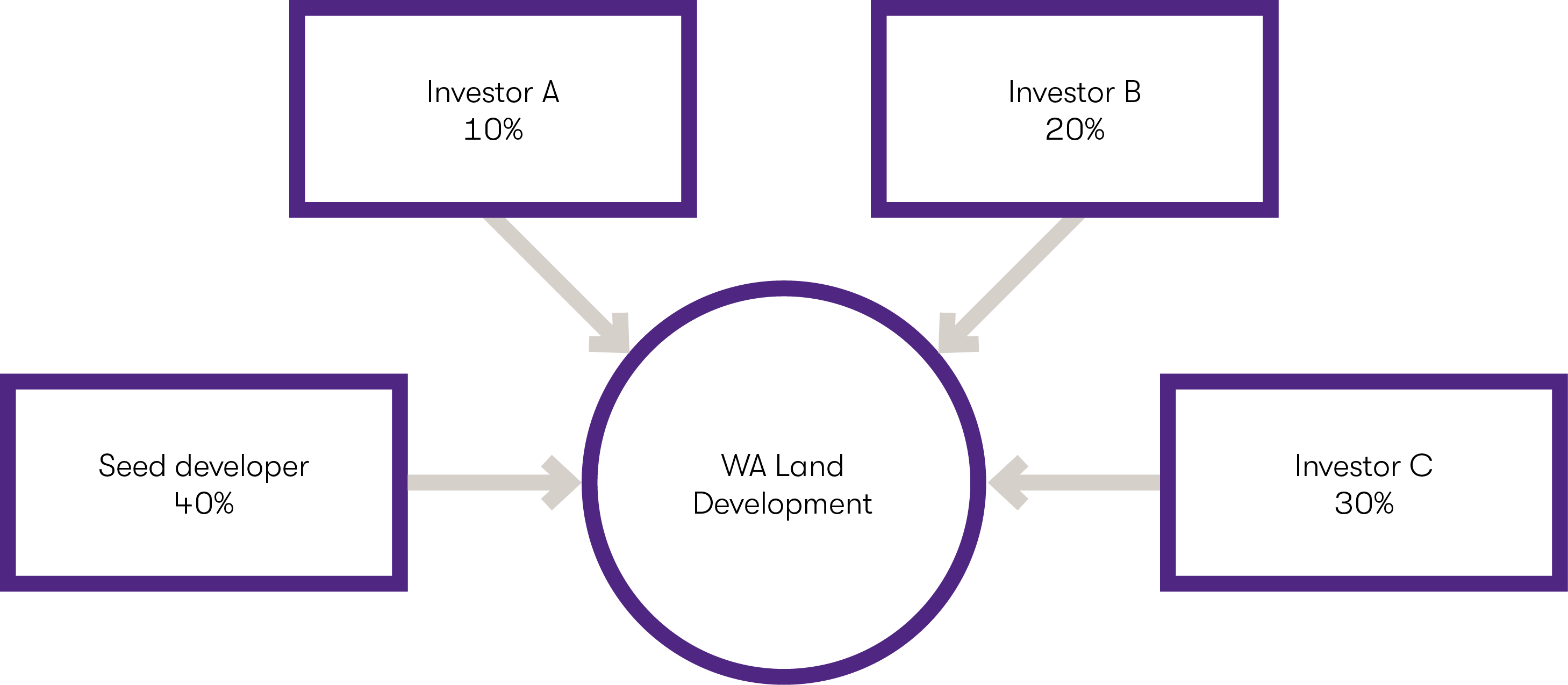

Example 1

If each of these investors acquired their interest at the same time, under the same agreement, for the same share price and on the terms of a mutually agreed shareholders agreement, it is likely that each of their interests would be aggregated on the basis that it “forms, gives effect to or arises from what is, substantially one arrangement”.

The ability for the Commissioner to determine that these types of arrangements should not be aggregated on the basis that they are acquired and employed independently and not acquired or employed for a common purpose has been removed for these types of circumstances.

If land is not yet acquired, the timing of entry into land acquisition documents to prevent effective double duty on the investment should also be carefully considered.

Unlike other jurisdictions, many acquisitions of interests in entities within a corporate group were not subject to landholder duty in Western Australia. The Amendments seek to bring Western Australia more in line with other States and Territories whereby any entity acquiring a 50% or more interest (or increased interest) is subject to landholder duty regardless of the ultimate ownership and relationship between the parties.

In addition, the connected entity exemptions are changing such that the exemption will be revoked if a transferee leaves the family (ie the corporate group) within three years of an exempt transaction. The proposed changes will make it more difficult to undertake such structuring without paying duty, particularly if it is in the context of a sale or selldown to an unrelated party. The new revocation provisions should not apply to transactions which happened before commencement.

The Amendments also introduce some further qualifying criteria similar to those found in Queensland which require that consideration cannot be provided by a person outside the family other than by way of loan.

The Amendments seek to aggregate certain transactions which would not have otherwise been (at least partially) subject to either transfer duty or landholder duty. Given the complex nature of the provisions, it is best illustrated through the following examples

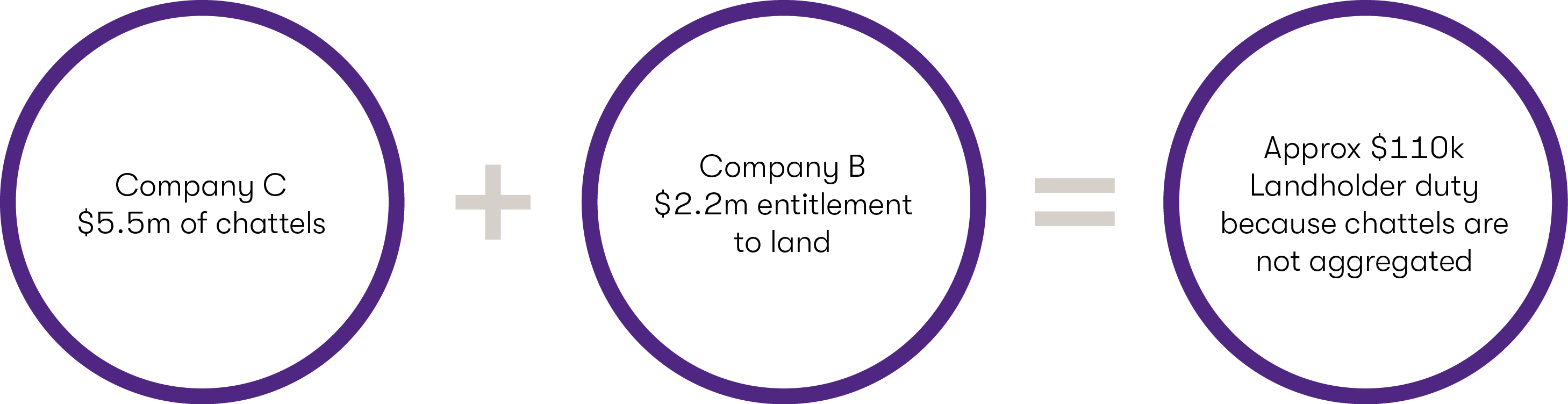

Separate acquisition of goods and a landholder

Previously a separate sale of a “landholder” and direct sale of goods would not give rise to a liability to duty on the value of the chattels. However, the Amendments aggregate a relevant acquisition and a transfer of chattels, such that the transfer of chattels become subject to transfer duty.

Example 2

Company B is a landholder and Company C holds chattels

Before amendments

After amendments

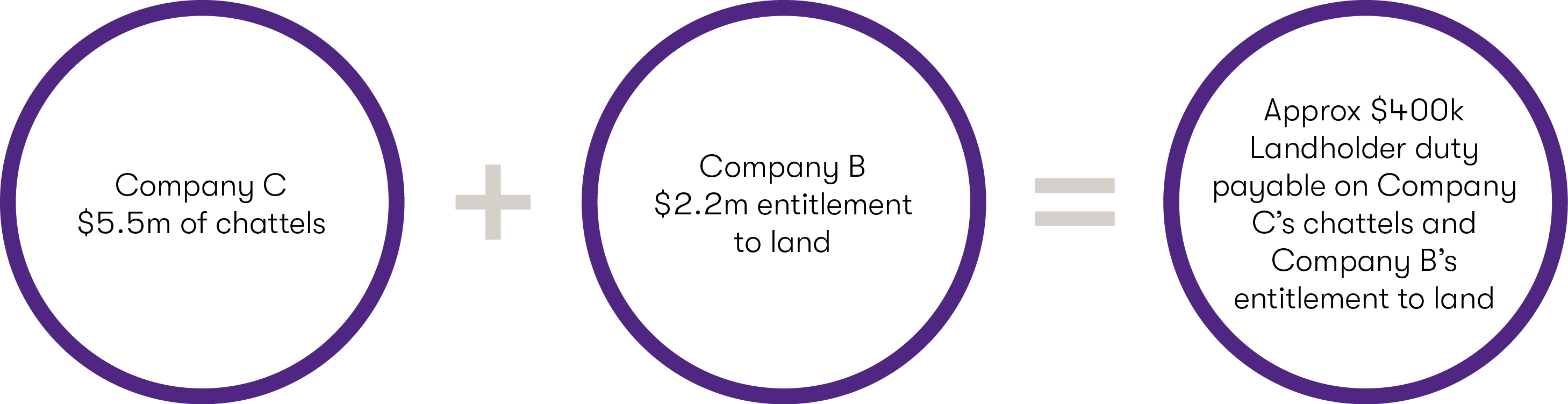

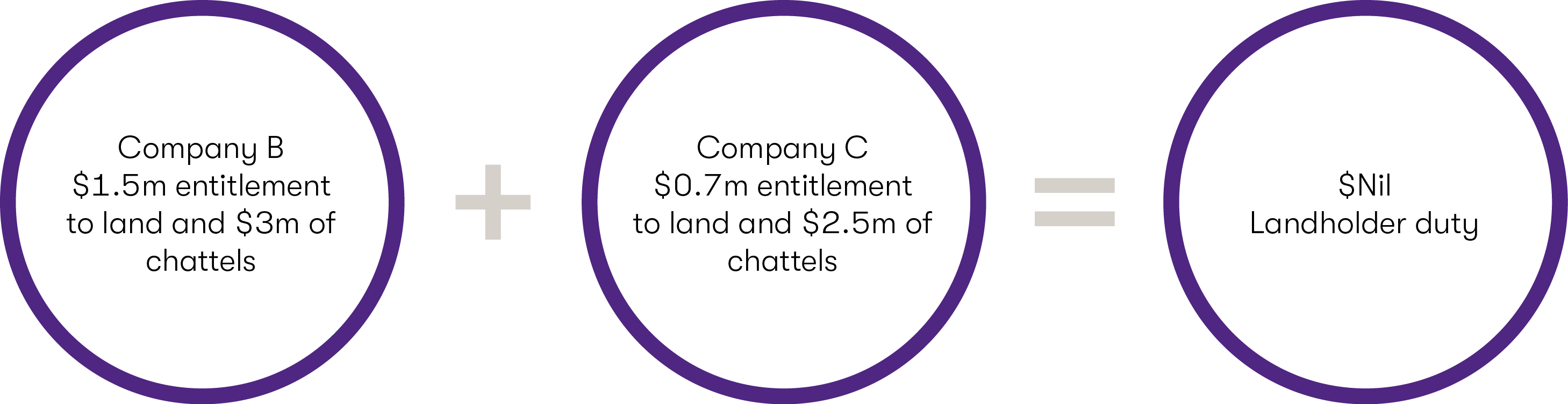

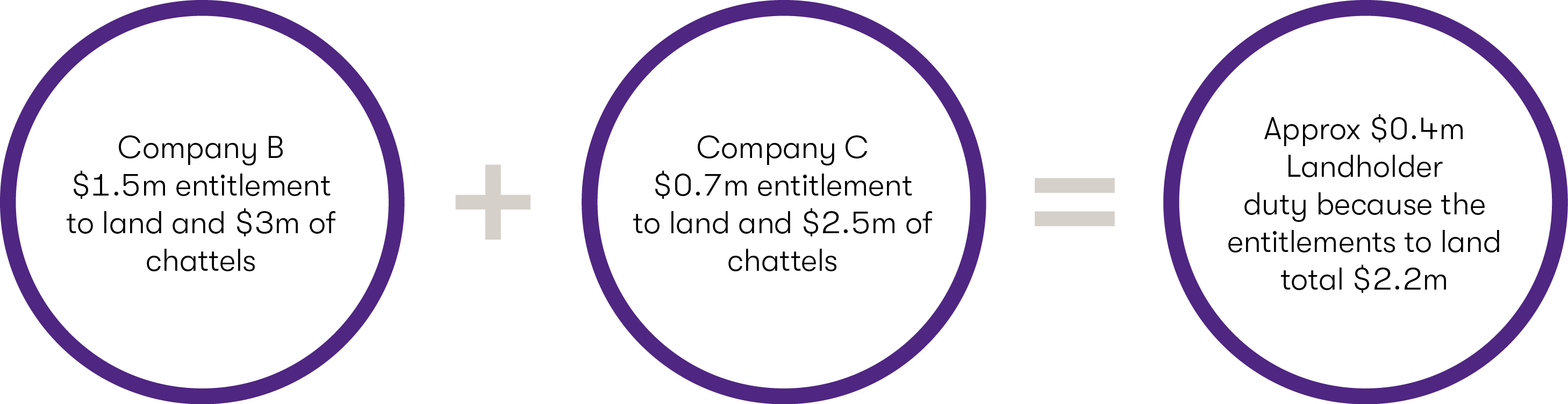

Aggregation of entities which are not separately a landholder

Previously the acquisition of two or more entities which do not individually have an entitlement to land at or above the landholder threshold of $2m would not give rise to any duty. However, the Amendments require all of the land to be counted together, making it more likely that an acquisition of a group of entities will be subject to landholder duty.

Example 3

Company A acquires Company B and Company C

Before amendments

After amendments

The same outcome would apply if Company B is a landholder and Company C had no entitlements to land in Western Australia. That is, an entity which only holds chattels would still be aggregated as a relevant arrangement even though it does not itself have an entitlement to land.

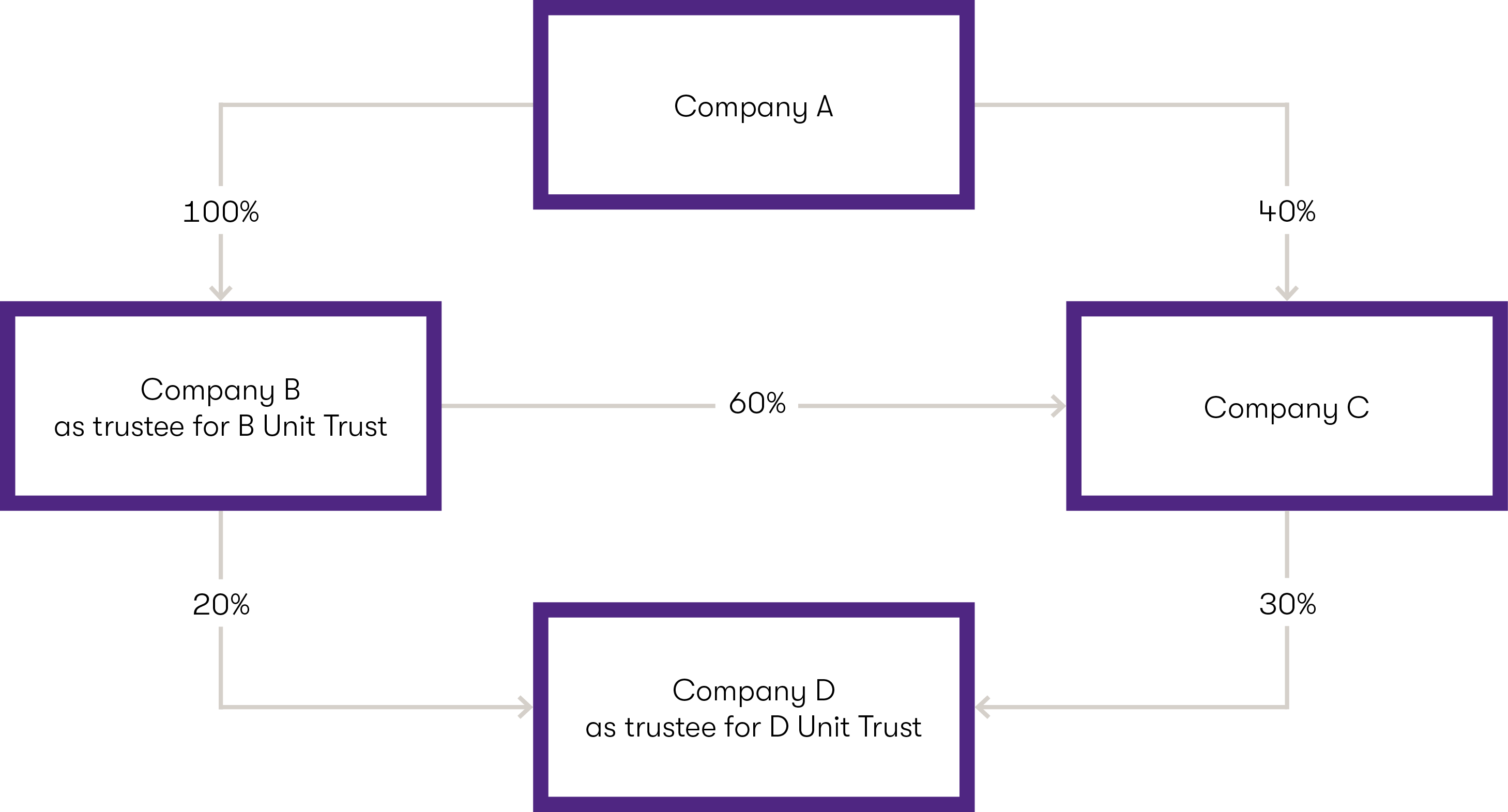

Corporate group structures can be quite complex. This can be due to a variety of reasons, including financing, risk and acquisition of legacy group structures. The Amendments broaden the “look-through” provisions such that various links to subsidiaries and other entities are combined in the effort to find a landholder, typically towards the bottom of a corporate group chain.

Example 4

Before amendments

Company A is not linked to D Unit Trust because neither B Unit Trust nor Company C is linked to D Unit Trust. Therefore, even if Company D as trustee for D Unit Trust is a landholder, it would not cause Company A to be a landholder, and an acquisition of Company A would not be subject to landholder duty.

After amendments

Company A now has a total direct or indirect interest in D Unit Trust of 50% and Company A is now linked to D Unit Trust. Therefore, if Company D as trustee for D Unit Trust is a landholder, Company A would also be a landholder, and an acquisition of Company A would be subject to landholder duty.

These changes could particularly apply to global corporate groups, particularly when undertaking upstream restructures, well above the Australian head entity. While most other jurisdictions have similar “look-through” provisions, corporate groups with significant entitlements to land in Western Australia may need to reconsider the way in which restructures are implemented, particularly with a view to ensuring it qualifies for a connected entity exemption if landholder duty would otherwise apply.

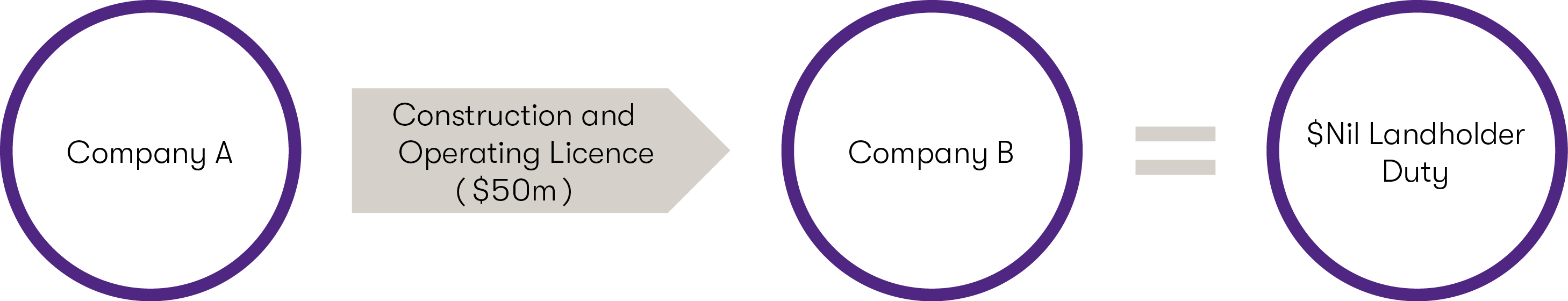

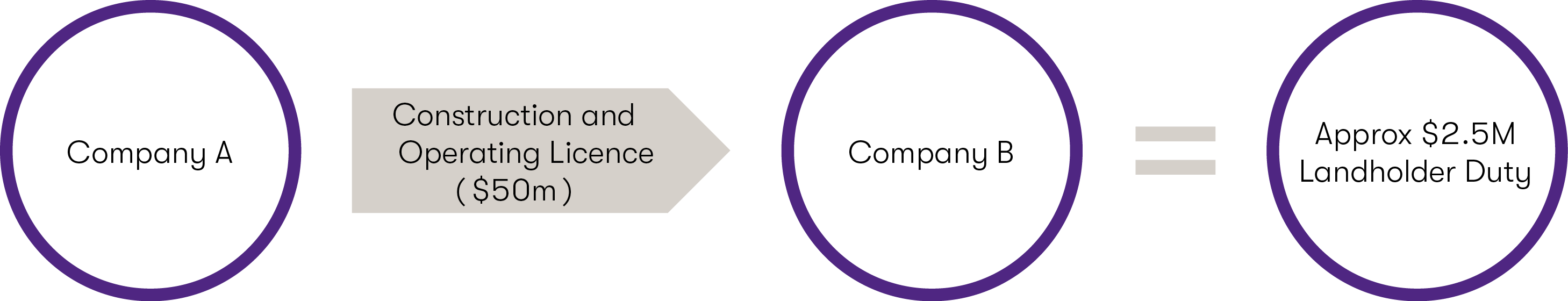

The Amendments introduce fixed infrastructure rights as a new category of dutiable property and land.

Rights of control, access or operation of fixed infrastructure where ownership is effectively acquired through a licence or contractual arrangement (rather than outright ownership) were not previously dutiable. However, the Amendments include such rights as dutiable property and land along with statutory licences authorising the ownership, operation or control of fixed infrastructure.

Further, rights of control (and in more limited circumstances rights of access and statutory licences) of fixed infrastructure will be treated as land for landholder duty purposes.

These measures may have a material impact on the financing and viability of infrastructure development for both private and government led developments. Such developments are historically modelled and financed on the basis of a “no duty” outcome, which is usually achievable in all States and Territories (including Western Australia before the Amendments). For that reason, we foresee stamp duty to be a material upfront consideration for modelling the financial viability of future infrastructure development in Western Australia.

These measures, coupled with the move to the “fixed to land” model described above, are also likely to have a material impact on the economics of the construction and development of renewable energy projects in Western Australia.

Example 5

Company A grants Company B a licence to construct, control and operate a hotel which is located on Company A’s land

After amendments

The Amendments also introduce a new category of dutiable property and “land”, being derivative mining rights. Historically it was the practice of the Commissioner to treat such rights as dutiable as an interest in a mining tenement. However, the Western Australia Court of Appeal rejected that interpretation in Commissioner of State Revenue v Abbots Exploration Pty Ltd [2014] WASACA. The Amendments have essentially been introduced to overcome that decision. Incidentally, the Queensland Commissioner was faced with a similar circumstance in its categorisation of certain mining rights as an interest in land, with the Supreme Court of Queensland upholding the taxpayer’s interpretation in Sojitz Coal Resources Pty Ltd v Commissioner of State Revenue [2015] QSC 9. The Queensland legislation was also amended.

A derivative mining right is essentially an authorisation for a person to explore for and mine specific minerals on a person’s tenement. The Amendments refer to an authorisation under section 118A of the Mining Act 1978 (WA), however it also refers to an authorisation “of a kind” described in that section, which is intended to incorporate private agreements which are not specifically granted under that section. It remains to be seen how close a private agreement needs to be to the legislation for it to be considered “of a kind” and therefore taken to be dutiable property or land (as the case may be).

The Amendments also include changes which have the following effect:

- Pastoral leases are included in the definition of “land”

- There is a broader application of the family farm exemption to include more relatives and structures.

- A change to the way in which duty is calculated on the retirement of a partner or dissolution of a partnership

- More prescriptive requirements are introduced to qualify for the concession concerning bare trustees, including a 60 day time limit for registration after a transfer has been stamped

- Introduction of a new concession applicable to subdivisions

- Introduction of an exemption for non-profit bodies upon winding up, transfer of incorporation or amalgamation

Overview of Land Tax Amendments

The Revenue Laws Amendment Bill 2018 (WA) (“Bill”) had its second reading speech in the Legislative Council on 7 May 2019 is awaiting the 3rd and final reading. The Bill seeks to make changes to the Land Tax Assessment Act 2002 (WA) as follows:

- The way in which land tax is calculated on partially exempt land is clearer, with the value apportioned by reference to the area of the land that is used for exempt and non-exempt purposes

- The exemption for land used as the primary residence of a disabled person is extended to land owned by a child of the disabled person

- The concessions and exemptions applying to land which is subdivided are tweaked to address technical timing and titling processes

- For primary production land where the owner is relying on a family member conducting a primary production business through a discretionary trust, all beneficiaries (not just individual beneficiaries) must now be a family member of the nominated beneficiary. As such, companies and charitable institutions could disqualify the trust as being a “family trust” which in turn could disqualify the application of the exemption. Taxpayers have been given until 30 June 2020 to vary the relevant trust deed to comply with the new requirements. Care should be taken that such a variation does not unintentionally give rise to a material stamp duty liability

These amendments also commence the day after assent of the Amendments.

Overview of Pay-roll Tax Amendments

The Pay-roll Tax Assessment Amendment Bill 2019 (WA) contains amendments to the Pay-roll Tax Assessment Act 2002 (WA) with the following issues to note.

- The changes seek to remove the pay-roll tax exemption for eligible new trainees with effect from 1 July 2019. Currently, a pay-roll tax exemption applies to salary and wages paid to new employee trainees, whose ordinary wages did not exceed $100,000 per annum at the time the training contract was lodged for registration with the Department of Training and Workforce Development

- The revocation of the pay-roll tax concessions as they apply to new trainee workers is estimated to produce Government savings of $109 million over the period 2019-20 to 2021-22

- Amendments to pay-roll tax concessions for new trainee workers are part of a two-stage package of measures announced by the Government on 30 November 2017 to better target training assistance provided to employers

- There will be a new incentive scheme that will be administered by the Department of Training and Workforce Development which proposes to give $8,500 to for employing an apprentice or new entrant trainee

- These amendments will not affect the exemption for wages currently paid to apprentices, which will continue to apply. Additionally, the transitional provisions preserve the exemption for the remaining term of eligible training contracts lodged with the Department of Training and Workforce Development prior to 1 July 2019

Overview of Taxation Administration Amendments

The Taxation Administration Amendment Bill 2018 (WA) amends the Taxation Administration Act 2013 (WA) to streamline some administrative processes and fix some grammatical errors as well as:

- With consent (which will presumably be a condition for the release of interim stamped documents for the purposes of registration), the Commissioner can lodge a memorial against land or mining tenements transferred to a taxpayer after payment of an interim assessment, which will remain in place until the final assessment is paid

- The Commissioner can also lodge a memorial against land or mining tenements owned by a taxpayer to secure unpaid duty that results from a reassessment or unpaid foreign transfer duty or foreign landholder duty

These amendments also commence the day after assent of the Amendments.