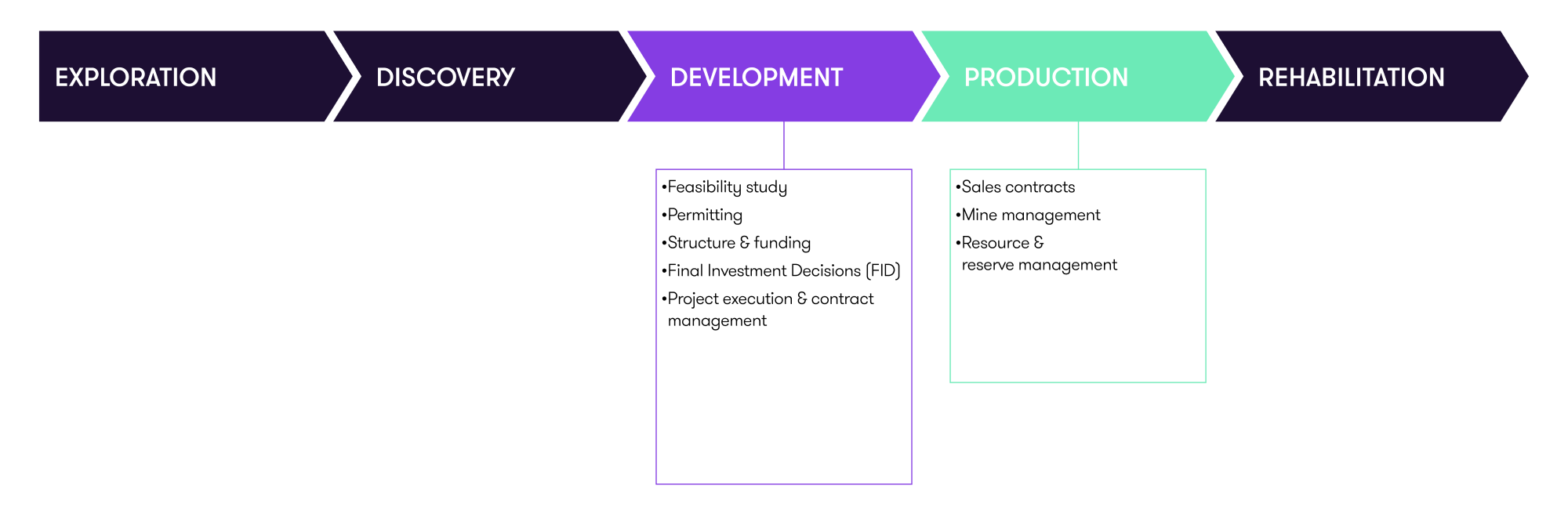

A deep dive into the accounting, tax and finance implications as you transition from exploration through development and ultimately, production.

Industry snapshot

-

![Industry snapshot]()

Growing demand from export markets and an increase in domestic production from iron ore mining has boosted industry revenue. Earnings are expected to rise a further 8 per cent to $334bn in 2021-22, and then fall back to around $300bn in 2022-23

-

![Industry snapshot]()

Mining entities with a strong Environmental, Social ad Corporate Governance (ESG) plan experienced a 10 per cent higher than average market index with a total shareholder return of 34 per cent over the past three years.

-

![Industry snapshot]()

The 2022 Federal Budget has committed $250 million to the critical minerals sector to become more globally competitive.

-

![Industry snapshot]()

The Australian mining industry generated $29.7bn in wages from 2017-2022.