- The revised Division 296 tax keeps the $3m threshold and introduces a new $10m tier, with earnings above these levels taxed at 30 per cent and 40 per cent respectively, and both thresholds indexed to inflation.

- It removes the proposed tax on unrealised gains, applies the tax at the individual level, and introduces new rules for calculating earnings, TSB, and optional CGT cost‑base resets.

- The changes take effect from 1 July 2026, creating planning opportunities but also requiring careful strategy, especially for those with high super balances, complex structures or significant unrealised gains.

Treasury has released the most recent rework of the proposed Division 296 tax.

Although it has provided some much-needed relief from the original draft, the rework now includes additional hurdles requiring careful planning and consideration.

Summary of the proposed Division 296 Tax

Threshold adjustments

The original $3m threshold remains, but a new $10m tier has been introduced.

- $3m-$10m: Division 296 earnings taxed at 30 per cent (existing 15 per cent concessional rate taxed to the superannuation fund plus 15 per cent Division 296 tax on Division 296 earnings on the proportion of member balance in excess of $3m).

- Above $10m: Division 296 earnings taxed at 40 per cent (existing 15 per cent concessional rate taxed to the superannuation fund + 25 per cent Division 296 tax on Division 296 earnings on the proportion of member balance in excess of $10m).

Indexation introduced

Both thresholds will now be indexed to inflation, preventing bracket creep and ensuring fewer Australians are unintentionally captured over time.

Assessed to individual, not the super fund

The tax is assessed to the individual, however you are able to elect to have the funds released from the super fund in the same way as a Division 293 tax assessment.

No tax on unrealised gains

The revised proposal removes the controversial element of taxing unrealised capital gains.

Implementation date

The revised tax framework is scheduled to commence from 1 July 2026, meaning the first Div 296 assessment will apply at 30 June 2027.

No refund for negative earnings

No refund for negative Division 296 earnings. In a year in which Division 296 earnings are negative, the assessment will be nil, and there will no longer be any carry forward losses to apply to future Div 296 gains, Any tax losses at a fund level will be carried forward and applied to future year gains which will ultimately be reflected in the members Division 296 earnings in future years.

Change to the Total Superannuation Balance (TSB) applied

The original bill applied the threshold to the individual's TSB at 30 June. This has now been revised to base it on the higher of the individual’s total superannuation balance at the start and end of the financial year.

This now limits any strategy to make large withdrawals in a financial year to bring the TSB below $3m to avoid Div 296 tax (noting the special transition rule in 2026-2027).

Special transition rule for TSB in 2026-2027

The percentage can be based on the individual's TSB at 30 June 2027 for that financial year only.

Change to the calculation of Division 296 Earnings

The initial draft legislation calculated this as:

Current Year TSB – Prior Year TSB + Withdrawals – net contributions.

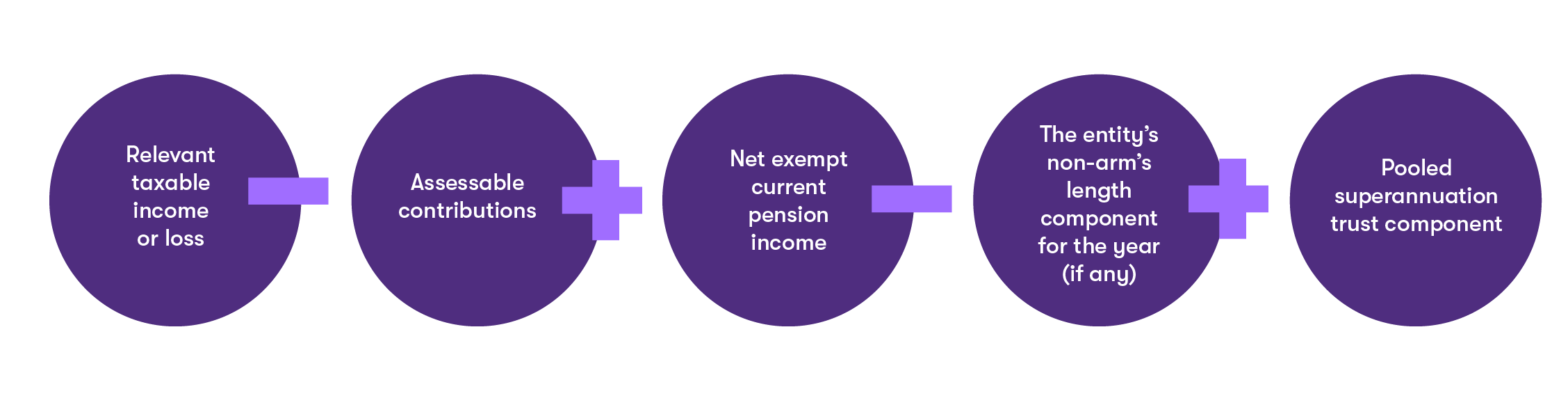

The new Division 296 earnings calculation is:

Capital gain cost base reset

For Div 296 purposes only, the cost base of capital gains tax assets can be reset via opt in to exclude large gains built up prior to 30 June 2026, potentially avoiding Div 296 on the full amount of gains when sold. However, this optional reset applies at the fund level, rather than an asset-by-asset basis, meaning that assets in an unrealised loss position will also have their cost base reset to their market value on 30 June 2026 for Div 296 tax purposes.

Allocation of earnings between members

How a super fund allocates earnings between members is yet to be determined, and we are likely to see further details of this in the regulations. The split may be determined via an actuarial certificate, which will incur additional costs to the fund.

A worked example for Bob and Jane

Take Bob and Jane who have an SMSF worth $15m at 1 July. Bob has $11m and Jane has $4m. The fund has managed investments, listed securities and cash. There has been no realised capital gains tax events during the year. Their member balances consist of both pension and accumulation accounts, and they have both taken $150,000 each in pensions for the year. Their closing balances at 30 June are $11.8m and $4.2m. The fund’s Division 296 earnings for the year is $900,000. They have no other superannuation accounts.

CGT cost base reset

This will not have any effect on the usual tax payable by the fund, however it will allow a reset of cost base, for Div 296 purposes only, to ultimately protect any realised gain built up to 30 June 2026.

There is a requirement to opt in by way of an approved form, which will be due on the due date of the 2026-2027 SMSF annual return. If the form is not lodged by this date, the fund will forgo the opportunity to apply for this relief. This emphasises the importance of lodging the 2026 annual return on time to receive the extended lodgement for 2027.

Unlike the 2017 CGT relief, funds cannot choose which investments to opt in on. If the fund opts in, it is opting in to all investments (even those in a loss position at 30 June 2026). This may be detrimental in some cases where an investment is in a loss position at 30 June 2026 (reducing the cost base to the market value), and then the investment recovers to its original cost when sold. In this event, the Division 296 earnings will include a capital gain which never really existed.

This relief is not just available to funds with members who have TSB’s over the thresholds. You may consider opting in if there is a chance your funds current investments are likely to grow over time, thereby locking in the reduction for future years.

Does Div 296 give rise to the double taxing on fully franked dividends?

There has been a lot of speculation that Div 296 will ‘double tax’ fully franked dividends. The definition of Division 296 Fund Earnings starts with the fund’s taxable income, which includes franking credits.

When a company pays a fully franked dividend, its grossed up to include the franking credit in the investor’s assessable income. The franking credit is then credited to the investor for the tax already paid by the company (avoiding double taxing).

A worked example with fully franked dividends

A fund receives a fully franked dividend of $3,000, grossed up to $4,286 including franking credits. The fund pays 15 per cent tax of $579 and receives a refund of credits of $1,286, resulting in a net refund of $707.

The fund has benefited from the franking credit by 15 per cent, as the fund only pays 15 per cent tax opposed to the 30 per cent franking credit. For those funds in pension or part pension, the benefit is greater again due to a reduction of tax due to tax-exempt income.

For Div 296, this grossed up franked dividend is included in the calculated earnings. Take the same example above and incorporate this to the percentage above the thresholds for Bob and Jane above.

In this example, the actuarial tax-exempt percentage is 10 per cent, therefore we will only include 90 per cent of the grossed-up dividend:

|

Fund tax |

|

|

Grossed up dividend – 90% |

$ 3,857 |

|

Tax payable by fund |

$ 579 |

|

Less franking credit refund |

-$ 1,286 |

|

Net refund to fund |

$ 707 |

|

Div 296 tax |

||

|

Bob |

Jane |

|

|

Super fund Div 296 - franked dividend 100% |

$3,129 |

$1,157 |

|

First component 15% |

||

|

% of balance above $3m |

75% |

28% |

|

Earnings applicable for Div 296 |

$2,347 |

$324 |

|

Tax at 15% - A |

$352 |

$49 |

|

Second component 10% |

||

|

% of balance above $10m |

15% |

$ - |

|

Earnings applicable for DIV 296 |

$469 |

$ - |

|

Tax at 10% - B |

$47 |

$ - |

|

Total Div 296 Tax (A + B) |

$399 |

$49 |

The total tax payable on the dividend is $1,026. The franking credit refund to the fund is $1,286, resulting in an overall net refund of $260.

Although Div 296 is levying additional tax at an individual level on grossed up dividends, the franking credit refund attributable to the member in the fund needs to be considered, which removes the notion of double taxation.

Planning considerations

With the tax expected to apply for the 2027 financial year, there is time to assess any plans and implement strategies prior to 30 June 2027 to reduce the impact of the Division 296 tax.

It’s critical to wait until the final legislation is passed rather than withdrawing funds prematurely in anticipation of the tax, as re-contribution may not be possible if the legislation does not proceed as expected.

For many, superannuation will remain a tax-effective structure even with the new tax. For others, it may be an opportunity to review their current and alternative investment vehicles to identify the most tax effective strategies moving forward.

We’re here to help

Div 296 represents a significant change for individuals with high superannuation balances. It is crucial for individuals to seek tailored advice and plan accordingly to navigate these changes and the implications for their superannuation and wealth strategies.

If you’d like to discuss your current superannuation strategy, please reach out to one of our experts today.

The above information is provided as an information service only and, therefore, does not constitute financial product advice and should not be relied upon as financial product advice. None of the information provided takes into account your personal objectives, financial situation or needs. You must determine whether the information is appropriate in terms of your particular circumstances. For financial product advice that takes account of your particular objectives, financial situation or needs, you should consider seeking financial advice from an Australian Financial Services licensee before making a financial decision in relation to any of the matters discussed.