If you wish to discuss any of the information included in this Technical Accounting Alert, please get in touch with your local Grant Thornton Australia contact or a member of the National Assurance Quality Team using the link below.

INTRODUCTION

Following recent decisions made at the Australian Accounting Standards Board (AASB) meetings, we now have a very clear sense of what the final Australian Sustainability Reporting Standards (ASRS) will look like.

The purpose of this alert is to summarise some of the key decisions made by the AASB at its Board meetings over the past few months, ahead of the final ASRS standards anticipated to be issued later this year, subject to the passage of legislation.

In summary:

- The AASB has changed the proposed structure of the final ASRS standards from the original exposure draft. The AASB is now intending to prepare a “non-mandatory” (i.e. voluntary) ASRS 1 standard that would cover sustainability-related financial disclosures, along with issuing ASRS 2, covering climate-related risks and opportunities, as a mandatory standard. ASRS 101 will also be issued to support both ASRS 1 and ASRS 2.

- The AASB has removed multiple proposed changes in the exposure draft of the standards, to better align the final ASRS standards with the IFRS Sustainability Disclosure Standards (IFRS SDS) as a baseline. However, there will be some areas where the IFRS SDS require additional disclosures that are not required in the mandatory ASRS 2 standard.

Separate to the final ASRS, additional disclosure requirements may be also mandated by the proposed amendments to the Corporations Act 2001. It is important to be aware that companies will need to consider both sources of disclosure requirements when preparing mandatory climate-related financial disclosures.

OVERVIEW

Over the past three months the AASB has considered the feedback received in response to the Australian Sustainability Reporting Exposure Draft ED SR1 (ASRS Exposure Draft) published by the Australian Accounting Standards Board (AASB) in October 2023.

The consultation process was extensive, with over 1,000 registrations for outreach activities, 117 comment letters, and 289 survey responses submitted to the AASB. The consultation included 29 specific questions for comment, and 6 general questions for comment, with 35 questions in total.

The AASB considered the feedback over four board meetings held between 14 May 2024 and 19 July 2024. The decisions made to date by the AASB cover two main aspects of the standards:

- the structure of the final ASRS standards; and

- the extent to which the final ASRS standards will be aligned to the IFRS SDS.

The AASB has also added a number of projects to the future workplan to address public sector considerations, and scalability and cost-benefit concerns. The timing and priority of these projects will be considered subsequent to the finalisation of the ASRS standards.

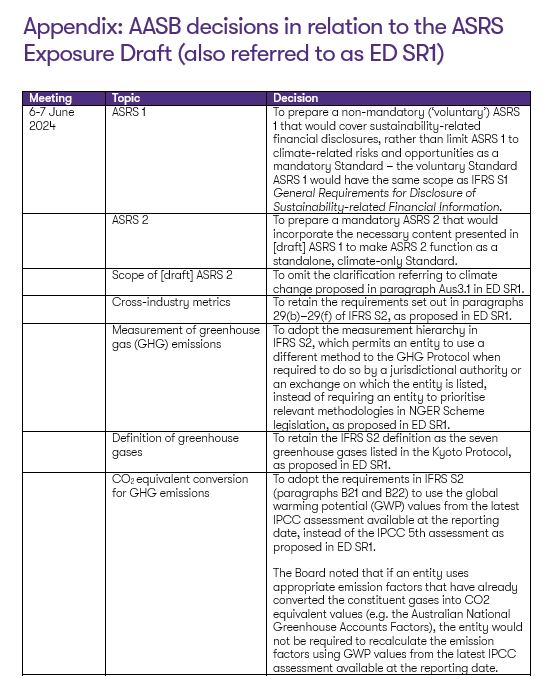

A full list of the AASB decisions made is available as an appendix.

Separate to the final ASRS, additional disclosure requirements may be also mandated by the proposed amendments to the Corporations Act 2001 contained in the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024. It is important to be aware that companies will need to consider both sources of disclosure requirement when preparing a Corporations Act 2001 compliant report.

THE STRUCTURE OF THE FINAL ASRS STANDARDS

The ASRS Exposure Draft was initially developed by the AASB with the intention to:

- develop Australian sustainability-related reporting requirements as a separate suite of standards to Accounting Standards;

- use the work of the International Sustainability Standards Board (ISSB) as a foundation, with modifications for an Australian-specific context where necessary to meet the needs of Australian stakeholders; and

- develop climate-related financial disclosure requirements that can be applied independently of any broader sustainability reporting framework, in alignment with the Australian Government’s direction to address climate-related financial disclosures first.

The IFRS Sustainability Disclosure Standards issued by the ISSB in June 2023 require an entity to provide information about the sustainability-related risks and opportunities that could reasonably be expected to affect an entity’s cashflows, access to finance, and cost of capital (also referred to as “an entity’s prospects”). These broader sustainability-related risks were contained in IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1). The ISSB also issued a topic standard IFRS S2 Climate-related Disclosures (IFRS S2).

As the Australian Government proposed that it would introduce requirements for climate-related disclosures first, the ASRS Exposure Draft initially limited the draft Australian-equivalent of IFRS S1 to climate-only, by replacing “sustainability-related” references with “climate-related”.

However, in response to stakeholder feedback the AASB has decided on a structure to the final ASRS 1 and ASRS 2 standards that would align more closely with the scope of both IFRS S1 and IFRS S2.

The revised structure is expected to be:

- a “mandatory” ASRS Standard [ASRS 2] that includes the necessary [draft] ASRS 1 content needed to make ASRS 2 function as the standard containing all of the requirements for climate-related financial disclosures;

- a “non-mandatory” ASRS Standard [ASRS 1] that incorporates all the content of IFRS S1 in respect of general requirements for the disclosure of sustainability-related financial information without modification; and

- a reference ASRS Standard [ASRS 101 References in Australian Sustainability Reporting Standards] which lists the relevant versions of non-legislative external documents referenced, both foreign and domestic in ASRS 1 and ASRS 2.

This approach means the final ASRS will have two Standards that closely correspond to the two existing IFRS SDS standards.

- Entities that only wish to comply with proposed mandatory climate-related financial disclosures will only need to adopt ASRS 2 and ASRS 101.

- Entities that wish to report in compliance with the IFRS Sustainability Disclosure Standards will need to adopt ASRS 1 in addition to ASRS 2 and ASRS 101.

The content of [draft] ASRS 1 that is needed to make ASRS 2 Climate-related Financial Disclosures function as a standalone standard, will likely be included in ASRS 2 as an appendix.

IFRS SUSTAINABILITY DISCLOSURE STANDARDS ALIGNMENT

The ASRS Exposure Draft included a number of areas of departure from the IFRS Sustainability Disclosure Standards. These differences were explained in our previous Sustainability Reporting Alert SRA 2024-1 Australian Sustainability Reporting Standards Exposure Draft ED SR1.

In response to stakeholder feedback the AASB has decided to align ASRS 2 with the baseline of IFRS S2 without modification in the majority of areas where the ASRS Exposure Draft initially proposed changes. These areas included:

- the scope of ASRS 2;

- cross-industry metrics;

- measurement of greenhouse gas emissions, including global warming potential (GWP) values;

- scope 2 greenhouse gas emissions approach;

- scope 3 greenhouse gas emissions data sources;

- financed emissions; and

- climate-related scenario analysis.

Additionally, the AASB has decided to align the majority of the content of [draft] ASRS 1, which will likely become an appendix to ASRS 2, with IFRS S1.

Of these decisions, one of the most significant changes from the ASRS Exposure Draft is the AASB’s decisions in relation to the measurement of greenhouse gas emissions.

In response to stakeholder feedback, the AASB decided to adopt the measurement hierarchy in IFRS S2, which permits an entity to use a different method to the Greenhouse Gas Protocol when required to do so by a jurisdictional authority or an exchange on which the entity is listed. This was instead of requiring an entity to measure greenhouse gas emissions by applying relevant methodologies and global warming potential values (GWP values) set out in the National Greenhouse and Energy Reporting Act 2007 and associated legislation, to the extent practicable, before applying other methodologies, as proposed in the ASRS Exposure Draft.

EXCEPTIONS TO ALIGNMENT

There are two notable exceptions to IFRS Sustainability Disclosure Standards alignment; scope of reporting, and industry-based disclosures.

Based on the AASB’s decisions to date, unlike the IFRS Sustainability Disclosure Standards, compliance with the final ASRS 2 standard and ASRS 101 standard only is not anticipated to require:

- disclosure of sustainability-related risks or opportunities, other than climate-related risks or opportunities, that could reasonably be expected to affect an entity’s prospects;

- a requirement to refer to and consider the applicability of disclosure topics in the SASB standards to identify sustainability-related risks and opportunities;

- a requirement to refer to and consider the applicability of disclosure topics in the Industry-based Guidance on Implementing IFRS S2 to identify climate-related risks and opportunities; and

- a requirement to refer to and consider the applicability of the metrics associated with the disclosure topics in Industry-based Guidance on Implementing IFRS S2.

The AASB noted this would not prevent an entity that wished to voluntarily provide some or all of these additional disclosures in their sustainability report from doing so.

However, all of the above requirements would be needed in order to report in compliance with the IFRS Sustainability Disclosure Standards.

NEXT STEPS

The AASB has stated an aspirational deadline of the end of August to finalise the ASRS Standards. Additionally, the AASB will require the Government to enact the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024 before it can issue the final ASRS standards with legal force.

At the time of writing, the bill is currently in the Senate and there are a number of proposed amendments expected to be debated. Subject to the legislation being enacted by the Parliament and receiving Royal Assent by 2 Dec 2024, the legislation will be in force for financial years commencing on or after 1 Jan 2025.

However, ASIC has made it clear that it expects entities should start putting into place the systems, processes and governance practices that will be required to meet new climate reporting requirements immediately, rather than wait for the passage of legislation.

HOW WE CAN HELP

Grant Thornton has a team of sustainability reporting specialists who understand the intricacies of the ASRS reporting requirements. Our team can work closely with you to navigate through the process of getting ready for ASRS reporting and IFRS SDS reporting, including:

- sustainability-related and climate-related risk and opportunity guidance;

- reporting gap identification;

- greenhouse gas emissions guidance;

- assurance readiness;

- sustainability and climate reporting support; and

- training and education.

FURTHER INFORMATION

If you wish to discuss any of the information included in this Sustainability Reporting Alert, please get in touch with your local Grant Thornton Australia contact or a member of the Sustainability Reporting team at sustainability.reporting@au.gt.com.