- Market services

- Indigenous advisory

-

Compliance audits & reviews

Our audit team undertakes the complete range of audits required of Australian accounting laws to help you to help you meet obligations or fulfil best practice procedures.

-

Audit quality

We are fiercely dedicated to quality, use proven and globally tested audit methodologies, and invest in technology and innovation.

-

Financial reporting advisory

Our financial reporting advisory team helps you understand changes in accounting standards, develop strategies and communicate with your stakeholders.

-

Audit advisory

Grant Thornton’s audit advisory team works alongside our clients, providing a full range of reviews and audits required of your business.

-

Corporate tax & advisory

We provide comprehensive corporate tax and advisory service across the full spectrum of the corporate tax process.

-

Private business tax & advisory

We work with private businesses and their leaders on all their business tax and advisory needs.

-

Tax compliance

We work alongside clients to manage all tax compliance needs and identify potential compliance or tax risk issues.

-

Employment tax

We help clients understand and address their employment tax obligations to ensure compliance and optimal tax positioning for their business and employees.

-

International tax

We understand what it means to manage tax issues across multiple jurisdictions, and create effective strategies to address complex challenges.

-

GST, stamp duty & indirect tax

Our deep technical knowledge and practical experience means we can help you manage and minimise the impact of GST and indirect tax, like stamp duty.

-

Tax law

Our team – which includes tax lawyers – helps you understand and implement regulatory requirements for your business.

-

Innovation Incentives

Our national team has extensive experience navigating all aspects of the government grants and research and development tax incentives.

-

Transfer pricing

Transfer pricing is one of the most challenging tax issues. We help clients with all their transfer pricing requirements.

-

Tax digital consulting

We analyse high-volume and unstructured data from multiple sources from our clients to give them actionable insights for complex business problems.

-

Corporate simplification

We provide corporate simplification and managed wind-down advice to help streamline and further improve your business.

-

Superannuation and SMSF

Increasingly, Australians are seeing the benefits, advantages and flexibility of taking control of their own superannuation and retirement planning.

-

Payroll consulting & Award compliance

Many organisations are grappling with a myriad of employee agreements and obligations, resulting in a wide variety of payments to their people.

-

Cyber resilience

The spectrum of cyber risks and threats is now so significant that simply addressing cybersecurity on its own isn’t enough.

-

Internal audit

We provide independent oversight and review of your organisation's control environments to manage key risks, inform good decision-making and improve performance.

-

Financial crime

Our team helps clients navigate and meet their obligations to mitigate crime as well as develop and implement their risk management strategies.

-

Consumer Data Right

Consumer Data Right (CDR) aims to provide Australians with more control over how their data is used and disclosed.

-

Risk management

We enable our clients to achieve their strategic objectives, fulfil their purpose and live their values supported by effective and appropriate risk management.

-

Controls assurance

In Australia, as with other developed economies, regulatory and market expectations regarding corporate transparency continue to increase.

-

Governance

Through fit for purpose governance we enable our clients to make the appropriate decisions on a timely basis.

-

Regulatory compliance

We enable our clients to navigate and meet their regulatory and compliance obligations.

-

Forensic accounting and dispute advisory

Our team advises at all stages of a litigation dispute, taking an independent view while gathering and reviewing evidence and contributing to expert reports.

-

Investigations

Our licensed forensic investigators with domestic and international experience deliver high quality results in the jurisdictions in which you operate.

-

Asset tracing investigations

Our team of specialist forensic accountants and investigators have extensive experience in tracing assets and the flow of funds.

-

Mergers and acquisitions

Our mergers and acquisitions specialists guide you through the whole process to get the deal done and lay the groundwork for long-term success.

-

Acquisition search & strategy

We help clients identify, finance, perform due diligence and execute acquisitions to maximise the growth opportunities of your business.

-

Selling a business

Our M&A team works with clients to achieve a full or partial sale of their business, to ensure achievement of strategic ambitions and optimal outcomes for stakeholders.

-

Operational deal services

Our operational deal services team helps to ensure the greatest possible outcome and value is gained through post merger integration or post acquisition integration.

-

Transaction advisory

Our transaction advisory services support our clients to make informed investment decisions through robust financial due diligence.

-

Business valuations

We use our expertise and unique and in-depth methodology to undertake business valuations to help clients meet strategic goals.

-

Tax in mergers & acquisition

We provide expert advice for all M&A taxation aspects to ensure you meet all obligations and are optimally positioned.

-

Corporate finance

We provide effective and strategic corporate finance services across all stages of investments and transactions so clients can better manage costs and maximise returns.

-

Debt advisory

We work closely with clients and lenders to provide holistic debt advisory services so you can raise or manage existing debt to meet your strategic goals.

-

Working capital optimisation

Our proven methodology identifies opportunities to improve your processes and optimise working capital, and we work with to implement changes and monitor their effectiveness.

-

Capital markets

Our team has significant experience in capital markets and helps across every phase of the IPO process.

-

Debt and project finance raising

Backed by our experience accessing full range of available funding types, we work with clients to develop and implement capital raising strategies.

-

Private equity

We provide advice in accessing private equity capital.

-

Financial modelling

Our financial modelling advisory team provides strategic, economic, financial and valuation advice for project types and sizes.

-

Payments advisory

We provide merchants-focused payments advice on all aspects of payment processes and technologies.

-

Voluntary administration & DOCA

We help businesses considering or in voluntary administration to achieve best possible outcomes.

-

Corporate insolvency & liquidation

We help clients facing corporate insolvency to undertake the liquidation process to achieve a fair and orderly company wind up.

-

Complex and international insolvency

As corporate finance specialists, Grant Thornton can help you with raising equity, listings, corporate structuring and compliance.

-

Safe Harbour advisory

Our Safe Harbour Advisory helps directors address requirements for Safe Harbour protection and business turnaround.

-

Bankruptcy and personal insolvency

We help clients make informed choices around bankruptcy and personal insolvency to ensure the best personal and stakeholder outcome.

-

Creditor advisory services

Our credit advisory services team works provides clients with credit management assistance and credit advice to recapture otherwise lost value.

-

Small business restructuring process

We provide expert advice and guidance for businesses that may need to enter or are currently in small business restructuring process.

-

Asset tracing investigations

Our team of specialist forensic accountants and investigators have extensive experience in tracing assets and the flow of funds.

-

Independent business reviews

Does your company need a health check? Grant Thornton’s expert team can help you get to the heart of your issues to drive sustainable growth.

-

Commercial performance

We help clients improve commercial performance, profitability and address challenges after internal or external triggers require a major business model shift.

-

Safe Harbour advisory

Our Safe Harbour advisory helps directors address requirements for Safe Harbour protection and business turnaround.

-

Corporate simplification

We provide corporate simplification and managed wind-down advice to help streamline and further improve your business.

-

Director advisory services

We provide strategic director advisory services in times of business distress to help directors navigate issues and protect their company and themselves from liability.

-

Debt advisory

We work closely with clients and lenders to provide holistic debt advisory services so you can raise or manage existing debt to meet your strategic goals.

-

Business planning & strategy

Our clients can access business planning and strategy advice through our value add business strategy sessions.

-

Private business company secretarial services

We provide company secretarial services and expert advice for private businesses on all company secretarial matters.

-

Outsourced accounting services

We act as a third-party partner to international businesses looking to invest in Australia on your day-to-day finance and accounting needs.

-

Superannuation and SMSF

We provide SMSF advisory services across all aspects of superannuation and associated tax laws to help you protect and grow your wealth.

-

Management reporting

We help you build comprehensive management reporting so that you have key insights as your business grows and changes.

-

Financial reporting

We help with all financial reporting needs, including set up, scaling up, spotting issues and improving efficiency.

-

Forecasting & budgeting

We help you build and maintain a business forecasting and budgeting model for ongoing insights about your business.

-

ATO audit support

Our team of experts provide ATO audit support across the whole process to ensure ATO requirements are met.

-

Family business consulting

Our family business consulting team works with family businesses on running their businesses for continued future success.

-

Private business taxation and structuring

We help private business leaders efficiently structure their organisation for optimal operation and tax compliance.

-

Outsourced CFO services

Our outsourced CFO services provide a full suite of CFO, tax and finance services and advice to help clients manage risk, optimise operations and grow.

-

ESG & sustainability reporting

There is a growing demand for organisations to provide transparency on their commitment to sustainability and disclosure of the nonfinancial impacts of their business activities. Commonly, the responsibility for sustainability and ESG reporting is landing with CFOs and finance teams, requiring a reassessment of a range of reporting processes and controls.

-

ESG & sustainability advisory

With the ESG and sustainability landscape continuing to evolve, we are focussed on helping your business to understand what ESG and sustainability represents and the opportunities and challenges it can provide.

-

ESG, sustainability and climate reporting assurance

As the demand for organisations to prepare information in relation to ESG & sustainability continues to increase, through changes in regulatory requirements or stakeholder expectations, there is a growing need for assurance over the information prepared.

-

Management consulting

Our management consulting services team helps you to plan and implement the right strategy to deliver sustainable growth.

-

Financial consulting

We provide financial consulting services to keep your business running so you focus on your clients and reaching strategic goals.

-

China practice

The investment opportunities between Australia and China are well established yet, in recent years, have also diversified.

-

Japan practice

The trading partnership between Japan and Australia is long-standing and increasingly important to both countries’ economies.

-

India practice

It’s an exciting time for Indian and Australian businesses looking to each jurisdiction as part of their growth ambitions.

-

Singapore practice

Our Singapore Practice works alongside Singaporean companies to achieve growth through investment and market expansion into Australia.

-

Insight Australian wine export strategies post-China tariff removalFollowing the recent removal of tariffs on Australian wine by China, the industry is keen to rebuild relations and explore the right export markets. This presents Australian wine producers with a chance to reassess their position in the global market.

Insight Australian wine export strategies post-China tariff removalFollowing the recent removal of tariffs on Australian wine by China, the industry is keen to rebuild relations and explore the right export markets. This presents Australian wine producers with a chance to reassess their position in the global market. -

Insight Identify your opportunities in the complex landscape of fuel tax creditsThe landscape of fuel tax credits (FTC) is constantly evolving due to ongoing economic and technological developments. This dynamic environment presents both challenges and opportunities for businesses with significant fuel consumption.

Insight Identify your opportunities in the complex landscape of fuel tax creditsThe landscape of fuel tax credits (FTC) is constantly evolving due to ongoing economic and technological developments. This dynamic environment presents both challenges and opportunities for businesses with significant fuel consumption. -

Client Alert March 2024 Update: NSW Grants for Net Zero Manufacturing and Physical SciencesSome major NSW grant programs have been announced, supporting projects in clean technology innovation, low carbon product manufacturing, renewable manufacturing and physical sciences.

Client Alert March 2024 Update: NSW Grants for Net Zero Manufacturing and Physical SciencesSome major NSW grant programs have been announced, supporting projects in clean technology innovation, low carbon product manufacturing, renewable manufacturing and physical sciences. -

Insight Navigating a complex Agribusiness, Food and Beverage deals landscape in 2024Despite a 14% global decline in Agribusiness, Food, and Beverage M&A deals, 2024 shows promise with expected global interest rate stabilisation. Given the sector's role in global sustainability, businesses can tap into opportunities in food manufacturing and waste minimisation.

Insight Navigating a complex Agribusiness, Food and Beverage deals landscape in 2024Despite a 14% global decline in Agribusiness, Food, and Beverage M&A deals, 2024 shows promise with expected global interest rate stabilisation. Given the sector's role in global sustainability, businesses can tap into opportunities in food manufacturing and waste minimisation.

-

Renewable Energy

Transformation through energy transition

-

Business Planning and Strategy

Having an honest, broad-reaching and thought-provoking discussion with a skilled, independent advisor can be the catalyst for clarity – a direction to take your business forward and an understanding of what is key to success.

-

Flexibility & benefits

The compelling client experience we’re passionate about creating at Grant Thornton can only be achieved through our people. We’ll encourage you to influence how, when and where you work, and take control of your time.

-

Your career development

At Grant Thornton, we strive to create a culture of continuous learning and growth. Throughout every stage of your career, you’ll to be encouraged and supported to seize opportunities and reach your full potential.

-

Diversity & inclusion

To be able to reach your remarkable, we understand that you need to feel connected and respected as your authentic self – so we listen and strive for deeper understanding of what belonging means.

-

In the community

We’re passionate about making a difference in our communities. Through our sustainability and community engagement initiatives, we aim to contribute to society by creating lasting benefits that empower others to thrive.

-

Graduate opportunities

As a new graduate, we aim to provide you more than just your ‘traditional’ graduate program; instead we kick start your career as an Associate and support you to turn theory into practice.

-

Vacation program

Our vacation experience program will give you the opportunity to begin your career well before you finish your degree.

-

The application process

Applying is simple! Find out more about each stage of the recruitment process here.

-

FAQs

Got questions about applying? Explore frequently asked questions about our early careers programs.

-

Our services lines

Learn about our services at Grant Thornton

-

Current opportunities

Current opportunities

-

Remarkable people

Our team members share their remarkable career journeys and experiences of working at Grant Thornton.

-

Working at Grant Thornton

Explore our culture, benefits and ways we support you in your career.

-

Current opportunities

Positions available.

-

Contact us

Get in touch

In our last article, we observed how the developed world’s common pandemic experience of cheap borrowing costs, unprecedented government economic stimulus, and the diversion of services/experience spending had resulted in a surge in demand for real estate across the globe, resulting in the highest levels of material and labour cost inflation experienced in the building and construction industry for many decades.

In our second instalment in this series, we explore time delays – a complementary issue to this unprecedented convergence of surging demand and restricted supply chains. Time can be a killer in business, none more so than for builders burning overhead and facing delay claims on wafer thin project margins.

Production shortages

Anecdotal reports suggest supplier lead times have blown out across all manner of materials including:

| Concrete Slabs | 1 week now 3 weeks |

| Concrete Pipe | 6 weeks now 30 weeks |

| Frames and Trusses | 3 weeks now 13 weeks |

Mathematics dictates that in a world where production of a particular product is constant and inventory is managed on a ‘just in time” basis, if demand for that product doubles, buyers may then have to wait twice as long for its delivery.

Are we currently experiencing a surge in demand combined with restricted supply? It seems so.

Timber Products

Structural Pine has received a good deal of press in recent months for being in short supply. Before COVID-19, the most significant economic event facing Australia was the 2020 bushfire disaster. While the Australian Forest Products Association represents 18 million hectares, it’s estimated that 50,000 hectares (or roughly 40%) of the softwood plantation area in the South West Slopes and Bombala regions of NSW were ravaged by bushfires that season. Over 6,000 hectares of plantations in northeast Victoria were also subject to fire damage, while approximately 95% of privately owned plantations on Kangaroo Island in South Australia were adversely affected. However, Australia was not alone in this issue, with California and Europe also experiencing large losses of commercial forestry reserves to wildfire across 2019-2020.

Builders are still at risk that suppliers, facing their own supply-chain issues, may fail to deliver the full ordered quantity on the scheduled time.

One local truss supplier confirmed that delivery times for raw materials can’t be predicted and suppliers have been pushing out agreed delivery dates. This is forcing them to order whatever stock they can get hold of from the suppliers, but still their facility is operating at only 75% capacity of what they could be producing.

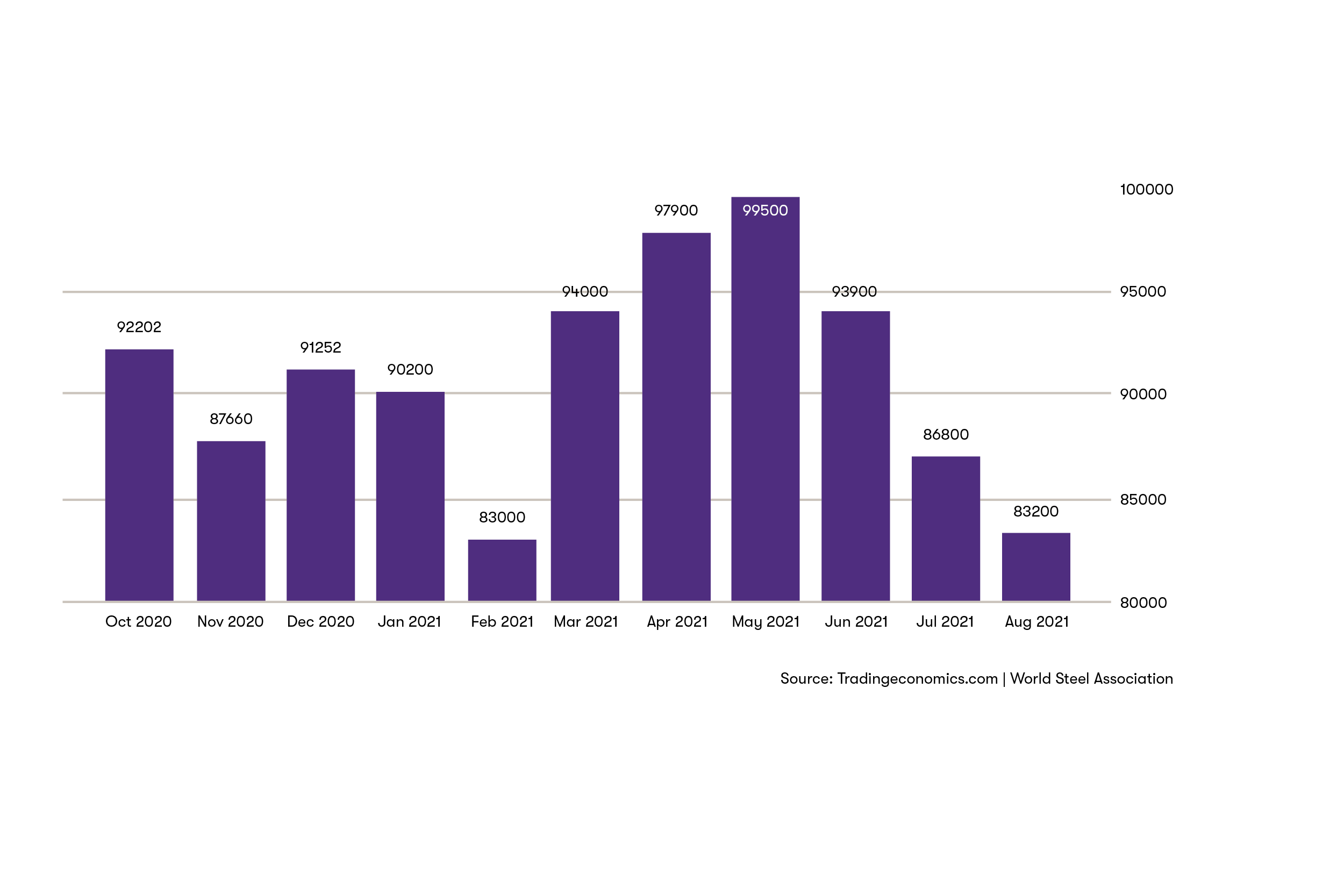

Reductions in Chinese steel production

While the majority of Australia’s steel is sourced domestically (Infrabuild and Bluescope), domestic producers alone have struggled to satisfy the current surge in demand. Bluescope Steel’s production volumes had already increased 15% in the year ended 30 June 2021.

Roughly 30% of Australia’s steel is sourced from China, and in an attempt to reduce carbon emissions, China has announced it will restrict the production of crude steel. With a reduction of almost 20% to date (from almost 100,000 kilotonnes in May 2021 to 83,200 kilotonnes produced in August 2021) - expectations are that in the short term at least, Beijing will continue to wind-back production to improve air quality for the Beijing Winter Games in February 2022.

China’s zero tolerance approach to managing the pandemic has also meant that recent outbreaks of the Delta strain continue to interrupt the operation of production facilities and mainland logistics networks.

While Rebar (short for reinforcing bar) prices have stabilised since peaking in May 2021, continued interruptions in Chinese supply could result in further price hikes if we assume global demand is at least sustained. On a positive note, the emerging ‘Evergrande’ problem in the Chinese Real Estate and Construction market suggests that the competition from mainland Chinese builders for steel over coming years could be subdued relative to recent years.

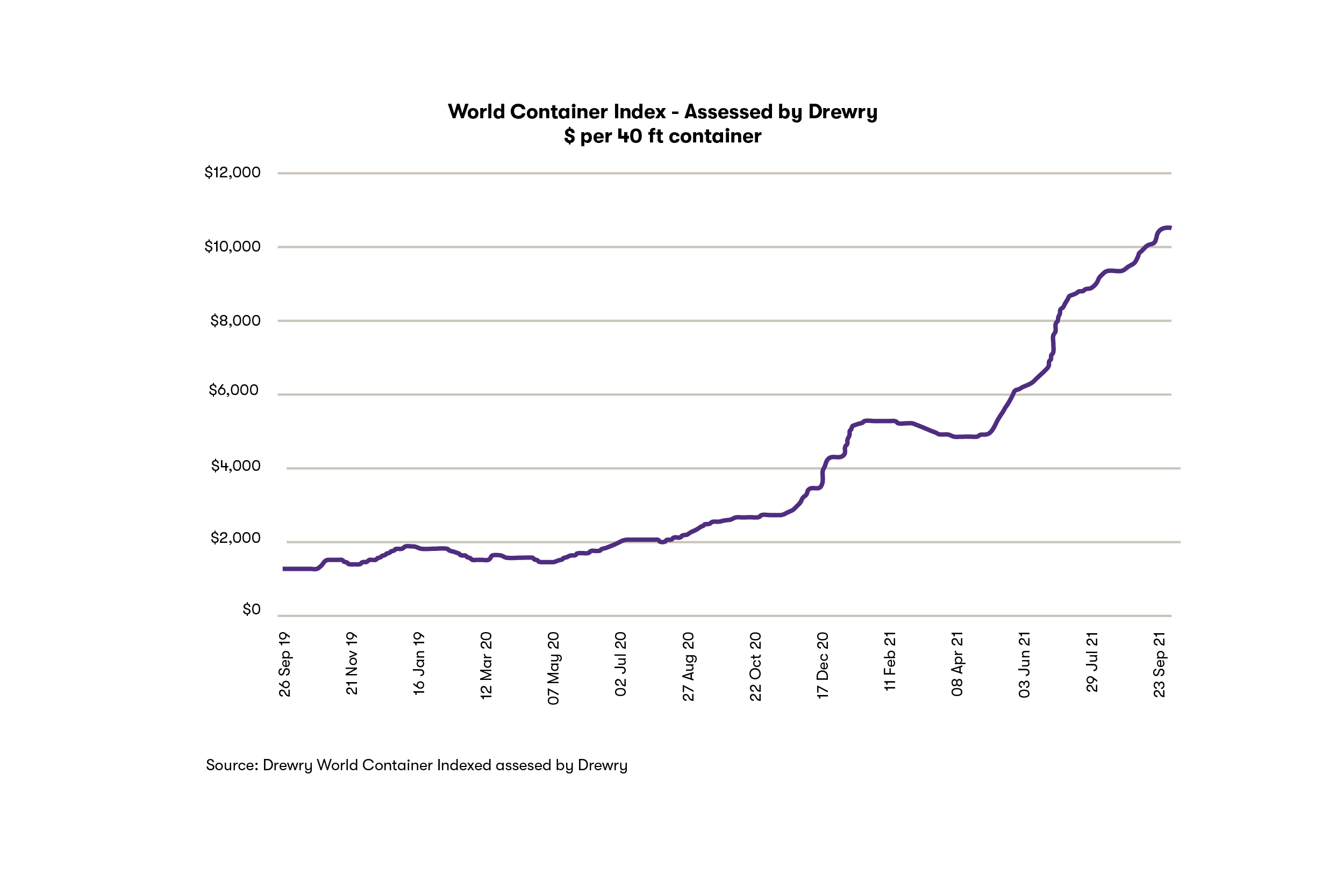

Delays in shipping

According to Freightos (an online digital booking platform), on 5 October 2021, the cost of shipping a 40 foot container from Shanghai to Sydney on the spot market was over A$11,000. Research consultancy firm Drewry report that the average cost of shipping a standard large (40ft) container is four times greater than it was a year ago, with the average door-to-door shipping time for ocean freight increasing from 41 days to 70 days.

Container ships move roughly 25% of the globe’s traded goods by volume. In response to the COVID-19 pandemic, shipping firms expecting a collapse in trade had idled 11% of the global fleet. However, consumer economies (including Australia and America), flush with cash, started spending and trade levels held.

In the first half of 2021, cargo volumes between Asia and North America were up 27% compared with pre-pandemic levels, according to the leading shipping owners association, BIMCO.

In this period of high demand and restricted supplies, pressure is on the shipping industry to move more goods. When new ship builds to increase capacity require a 2-3 year wait, they have limited opportunity to respond quickly - hence the prices rise while demand remains high.

It’s not only the vessels to run the routes, but the limited supply of containers that is causing the delays and both are contributing to the shortage of building material imports. The bulkier the goods, the greater the impact of higher shipping costs. Kwame Asumadu, director of Victorian-based importer WoodPanels Australia, recently wrote to Liberal MP Tim Wilson, chairman of the standing committee on economics, stating the costs of shipping a 40-foot container from New Zealand to Australia had risen by thousands of dollars over the past six months and that shipping lines appeared to be rationing space, contributing to the shortage of building materials in Australia.

The worst may yet be to come, with suggestions that up to 60% of goods to this point were covered under pre-fixed shipping rates and only the balance exposed to soaring spot prices.

Retailers will also be scrambling to stock the shelves as we head into Christmas, which has prompted “peak season” surcharges for all cargo from many Asian ports to Australia. Australian builders will be vying for space and paying a premium to get hold of imported materials through the pre-Christmas rush.

Even once the goods arrive, delays have been encountered at ports in Sydney and Melbourne, which have suffered temporary closures because of workers testing positive to coronavirus.

Where to from here?

According to the Australian Steel Association, import prices have almost doubled over the past year for structural steel products. However the chief concern for many builders right now is not the extra cost of steel, but how the delayed supply is impacting their delivery obligations and resourcing costs.

To this end, reliability is now the key decision driver when choosing suppliers. What was previously a global trend of “just in time” inventory management has now been replaced with “just in case”, and an increased willingness (where possible) to buy locally even at a premium?

Demand for building products remains strong and experts expect it may be at least 6-12 months before the current surge in global demand begins working its way through the supply chain bottlenecks.

In the meantime, labour shortages and government restrictions on on-site staffing present further delay risks on projects.

Key Parties at risk

Again, the extent of delays experienced by builders in the delivery of materials will vary between operators. Larger established operators will likely hold sufficient purchasing power and relationships to get to the front of the queue for materials as they become available. Smaller operators by comparison may be more exposed with minimal material purchasing power.

Anecdotal feedback from industry participants suggests that the average build period for detached dwellings has increased from seven months pre-pandemic to the current timing of up to eleven months. Assuming that workers cannot be readily deployed onto other productive projects during wait periods, this could translate to a reduction in monthly turnover of greater than 30%. The risk of material delays when combined with the cost pressures detailed in our previous article, hardly make for ideal business conditions.

Builders who contracted ambitiously on terms and price to secure pipeline revenue in late 2020 and early 2021 – a time when the most significant supply chain constraints hadn’t manifested – are most at risk of incurring significant losses as a result of delays and cost blow-outs occurring while delivering these projects in the current cycle.

Recommendations

Additional lead times need not result in project delays if project delivery plans order key materials sufficiently in advance. Notwithstanding this, the current environment presents an elevated risk of eating into preliminaries at the front end of contracts, and delay claims at the back end.

While the apparent solution is for builders to avoid contracts that leave them exposed to punitive or liquidated damages resulting from delays, their inclusion in contracts is more often than not the norm demanded by developers and financiers alike. Where a ‘cost-plus’ or ‘schedule of rates’ arrangement is off the table, builders should ensure that either project milestones documented in the contract are set conservatively, or the contract ‘protection’ is available to the builder to accommodate continuing experiences of supply chain disruption.

Mitigating damage on existing commitments

The impact of delays and inflation on materials over the last 6 months is likely to render many projects committed as fixed arrangements prior to then as unprofitable for builders. Quantifying the likely financial impact of delays in terms of lost margin, burnt overhead and people costs, along with potential damages exposure to principals can be a challenge, but scenario modelling the likely impact on the business will support strategies to:

- Update project delivery plans to ensure key materials (such as framing) are ordered sufficiently in advance;

- Consider assuming responsibility for key material supplies from subcontractors (such as framing) if concerns exist as to the capacity of subcontractors to deliver on time;

- Encourage transparent dialogue with key subcontractors and suppliers so that emerging issues are dealt with proactively rather than reactively.

- Ensure risk points are raised during PCG (Project Control Group) meetings;

- Negotiate variations of contract terms, consider reasonable delay buffers where external factors persist;

- Bulk order materials in short supply – where available;

- Engage with financiers to ensure continuity of existing facilities critical to future operations (e.g. bank guarantees and equipment finance);

- Maintain liquidity (including securing fresh debt or equity funding); and

- Ensure the business remains compliant with regulatory covenants (QBCC-MFR and Government Pre-Qualified Contractors).

Ensuring the business is protected on new projects (in addition to the above)

- Provide shorter turnaround time on the validity of quotations;

- Explore options to contract on a cost-plus basis/ schedule of rates (is possible);

- Nominate at-risk materials to be subject to cost-escalation clause; and

- Incorporate further protections in contracts (extensions of time, contingent start date based on availability of materials).

How can we help?

The team at Grant Thornton Australia can offer its expertise to assist builders, developers, financiers or other key stakeholders navigate distress, in various ways:

- Quantifying the financial impact of these market factors on business cash flow;

- Connecting data provided by quality surveyors to create dynamic cash flow forecasts, specified to contract terms and the pipeline of specific businesses;

- Assist in securing finance to improve working capital, via debtor financiers, alternate debt or extension of existing bank facilities;

- Assist negotiating with key counterparties, such as the ATO, contract principals or sub-contractors; and

- Managing regulatory compliance with bodies like the QBCC or State Government pre-qualifications.

While price volatility and risk presents a major challenge for builders, developers and financiers alike, the exploding lead times and delays of materials contribute to further headaches. It may get worse for some materials before it gets better. The contrasting outcomes for businesses that reactively vs proactively manage these risks are likely to be stark.

1 ‘Unprecedented times’ for ocean freight as fees soar

2 Economist - September 18-24th 2021 (Page 63)

Supply chain risk management in the COVID building boom

Watch this webinar on-demand as we host a panel discussion on the ways businesses are responding to supply chain challenges and when supply/demand may return to normal – if at all.