If you wish to discuss any of the information included in this Technical Accounting Alert, please get in touch with your local Grant Thornton Australia contact or a member of the National Assurance Quality Team using the link below.

- The National Climate Risk Assessment (NCRA), released by the Australian Climate Service in September 2025, identifies 63 nationally significant climate risks across eight key systems.

- The Australian Government selected 11 priority risks for deeper analysis. These include threats to coastal communities, critical infrastructure, health and wellbeing, ecosystems, and primary industries.

- The National Adaptation Plan released by the Department of Climate Change, Energy, the Environment and Water (DCCEEW), represents the "prioritise and plan" phase of Australia’s climate adaptation cycle.

INTRODUCTION

The purpose of this Alert is to draw attention to the National Climate Risk Assessment report (or NCRA), delivered by the Australian Climate Service on 15 September 2025. The primary role of the risk assessment is not to make the case for mitigation actions, but rather to inform Australia’s adaptation actions under the National Adaptation Plan (or NAP).

As many entities prepare to identify their climate-related risks and opportunities in line with the requirements of mandatory climate-related disclosures, the NCRA and NAP are excellent resources providing clear and accessible examples of how an entity might identify climate-related risks and mitigate risks through adaptation actions. Mandatory climate-related disclosures will also provide up-to-date, reliable and accessible information to inform national adaptation planning at the Government level.

This document is heavily based on the NCRA and NAP. Certain additions/amendments have been made for clarity and/or inclusion of additional guidance only. This is not an exhaustive list of all of the contents of the reports and does not replace reading the reports themselves.

Highlights

- 63 nationally significant climate risks identified, with 11 priority climate risks assessed in detail

- 8 key functional systems assessed: Aboriginal and Torres Strait Islander Peoples, Communities – urban, regional and remote, Defence and national security, Economy, trade and finance, Health and social support, Infrastructure and the built environment, Natural environment, and Primary industries and food

- 10 priority climate hazards identified: Changes in temperature (including extremes), Drought and changes in aridity, Bushfires, grassfires and air pollution, Extratropical storms, Convective storms (including hail), Tropical cyclones, Riverine and flash flooding, Coastal and estuarine flooding, Coastal erosion and shoreline change, and Ocean warming and acidification

- 4 key cross-system risks identified: Coast communities and settlements, Governance, Supply chains, Water security

- The near term risks to all systems are considered Moderate to High, increasing to Very high to Severe in the medium term (2050) time horizon

- Mandatory climate-related disclosures will support increased national adaptive capacity: The disclosure of up-to-date, reliable, and accessible information regarding the management of climate risk will be used to support national adaptation planning.

Impact for AASB S2 reporting entities

AASB S2 requires an entity to consider all reasonable and supportable information available to the entity at reporting date without undue cost or effort when identifying its climate-related risks and opportunities. As publicly available documents, the NCRA and NAP are examples of information that is available to entities without undue cost or effort.

Entities should consider the how the reports may:

- assist them in identifying new climate-related risks or opportunities;

- assist in identifying material information in relation to their identified climate-related risks or opportunities;

- cause an entity to reevaluate any previously identified climate-related risks or opportunities, or the materiality of information about those climate-related risks or opportunities; and

- assist in their planned strategic response to their climate-related risks and opportunities, including consideration of any adaptation actions.

Although climate-related risks and opportunities are specific to the business model and value chain of each entity, the 63 nationally significant climate risks identified in the NCRA provide an authoritative starting point and national benchmark for all reporting entities to consider.

Approach to understanding climate risk

The NCRA applied a risk-based approach to identify, assess, and provide a comprehensive analysis of the potential risks and impacts from a changing climate for various sectors across Australia, including the economy, agriculture, health, infrastructure and ecosystems. This approach is guided by the Intergovernmental Panel on Climate Change (IPCC) approach to understanding climate risk, by considering the interaction between risk elements, including hazards, vulnerability, exposure, and response.

The report focuses on residual risk, or the risk that remains after mitigation and adaptation actions are implemented. This included consideration of current climate impacts and risks, future changes to risk determinants for each system and existing adaptation efforts, including both planned and autonomous (unplanned) responses.

In assessing residual risk, the Australian Climate Service commissioned an Australian Adaptation Stocktake. This draws on a newly compiled Australian Adaptation Database of over 670 publicly available examples of adaptation policies, plans, projects, and actions across local, state, and national levels in Australia.

Nationally significant climate risks

The report considers what is at risk nationally from climate change and provides observations at a national scale across 8 key functional systems. The report identified 63 nationally significant climate risks grouped according to these key systems (see Figure 1).

Figure 1: An overview of Australia’s nationally significant climate risks identified across 8 key functional systems (Australian Climate Service 2025).

While some of these risks are likely to be highly relevant to many Australian entities, including Risks to Economy, trade and finance, and others are likely to be highly relevant to specific sectors, all 63 nationally significant climate risks are likely to impact Australian entities, but to varying degrees. This is because all Australian entities are operating within the Australian economy, which is impacted by climate risks across all key functional systems. For example, Risks to Health and social support include risks to service delivery and the workforce. As such, an entity with a workforce may be impacted, albeit to varying degrees influenced by factors including the vulnerability and exposure of the workforce to the impacts of climate change, such as an increasing number of extreme heat days.

Priority risks

Of the 63 nationally significant climate risks identified, 11 priority risks were selected by the Australian Government for further analysis. These 11 priority risks are used in the report to provide a consolidated understanding of Australia’s climate risk. Analysis of the priority risks anchors the Australian Government’s understanding of how each of the 8 functional systems is at risk.

These include:

- Coastal communities and settlements: Risks to coastal communities from sea level rise, particularly where legacy and future planning and decision-making increases the exposure of settlement.

- Concurrency pressures in emergency response and recovery: Risks to domestic disaster response and recovery assistance from the competing need to respond to multiple natural hazard events resulting in concurrency pressures and overwhelming the capacity of all levels of government to effectively respond and to do so while reducing reliance on the Australian Defence Force.

- Critical infrastructure: Risks to critical infrastructure that impact access to essential goods and services.

- Governance: Risks to adaptation from maladaptation and inaction from governance structures not fit to address changing climate risks.

- Health and wellbeing: Risks to health and wellbeing from slow-onset and extreme climate impacts.

- Natural ecosystems: Risks to ecosystems, landscapes and seascapes, including risk of ecosystem transformation or collapse, and loss of nature’s benefits to people.

- Primary industries: Risks to primary industries that decrease productivity, quality and profitability and increase biosecurity pressures.

- Real economy: Risks to the real economy from acute and chronic climate change impacts, including from climate-related financial system shocks or volatility.

- Regional and remote communities: Risks to regional, remote and Aboriginal and Torres Strait Islander communities that are supported by natural environments and ecosystem services.

- Supply chains: Risks to supply and service chains from climate change impacts that disrupt goods, services, labour, capital and trade.

- Water security: Risks to water security that underpin community resilience, natural environments, water-dependent industries and cultural heritage.

While these 11 priority risks are likely to affect most Australian entities across the short, medium, or-long term, the extent to which a particular entity is at risk is dependent upon their specific circumstances, including their business model and value chain, and their strategy for adapting to these risks.

Cross-system and cascading risks

An important concept covered in the NCRA report is the interconnectedness of climate risks. In addition to 11 priority risks, the report identified 4 key cross-system risks, including Coast communities and settlements, Governance, Supply chains, Water security. The report provides insights into how each priority risk interacts within and across systems and how impacts can cascade across systems, supporting a broad understanding of the complexity of national climate risk.

“Changes to any one aspect of Australia's climate will not exist in isolation. Rather, impacts in one area or system may cause cascading and compounding impacts in other areas and systems (Australian Climate Service, 2025)”

For example, when considering Risks to the Economy, trade and finance system, the report highlights how impacts on one sector can quickly spread to others through a complex web of interdependencies. Disruptions in supply chains can lead to shortages of essential goods, affecting businesses and households. Novel risks and high-impact, low-likelihood events can destabilise financial markets, leading to broader economic consequence.

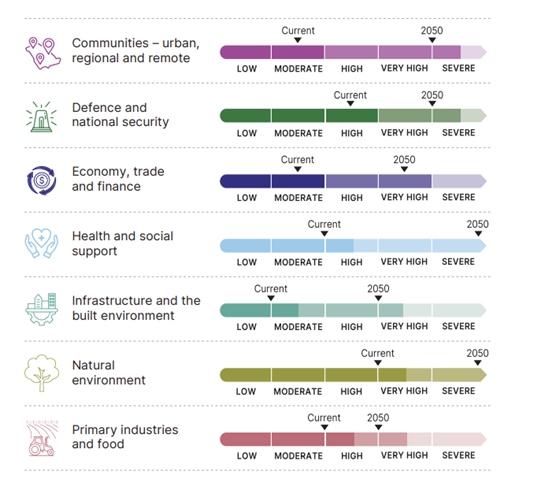

Climate risk ratings

With consideration of the 11 priority risks, the NCRA assigns a risk rating to each of the 8 key functional systems. Risk ratings use two timeframes, including ‘current’ and 2050. The timeframes consider a 20-year window centred on the year. The ‘current’ risk considers impacts that have happened, or could happen between 2011 and 2030, while the 2050 risk evaluation considers the 20-year window from 2041 to 2060. The report acknowledges the uncertainty of evaluating systems by 2090 due to their dynamic nature.

Rating categories have been developed to describe the impacts and risks to systems. These are qualitative ratings, based on the weight of evidence and expert judgment. These ratings aim to inform decision-makers on the severity of expected impacts, and to inform decision-making regarding the prioritisation of adaptation actions. It should be noted that future ratings assume no change in adaptation investment or approach.

Figure 2: An overview of risk ratings for climate risks to Australia’s key functional systems, both now and in the future (Australian Climate Service 2025).

These climate risk ratings indicate:

- In the near term, Australia is facing risks ranging from Moderate to High, across all key functional systems, increasing to Very high to Severe in the medium term;

- By 2050, Australia will face Very high risks across Economy, trade and finance, Infrastructure and the built environment, and Primary industries and food; and

- By 2050, Australia will face Severe risks across Communities – urban, regional and remote and Defence and national security.

Climate hazards

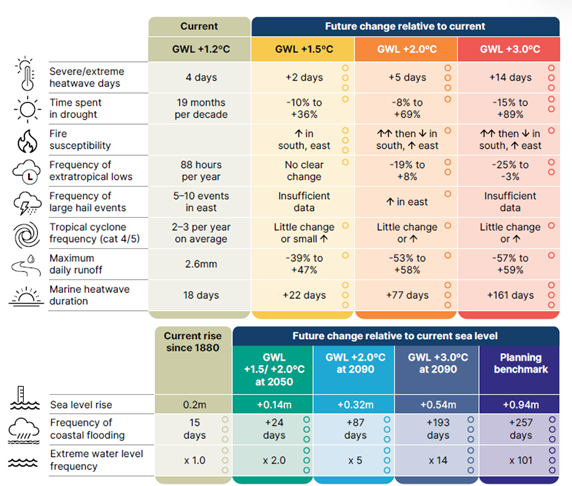

Finally, the NCRA identifies 10 priority climate hazards that are likely to have the greatest impact on Australia’s social, economic, built and natural environments over the next century.

The 10 priority hazards are reflective of the fact that natural clusters of hazards often occur together as a compound hazard and have a greater impact when they combined. For example, the extent of estuarine flooding depends on both sea level rise and rainfall. A combination of these hazards will exacerbate the risk. Therefore, analysing these hazards together creates a more holistic national understanding of risks now and in the future and is a more powerful way to support preparedness and response.

Figure 3: An overview of how the 10 priority climate hazards are expected to change across Australia for each global warming level compared with the current climate. Circles indicate a confidence rating based on the direction of change. 3 circles = high confidence, 2 circles = medium confidence, 1 circle = low confidence (Australian Climate Service 2025).

The top table in Figure 3 represents potential changes to hazards under different global warming levels (+1.5°C, +2°C and +3°C). These potential changes are relative to the current climate (+1.2°C). The bottom table in Figure 3 represents how hazards related to sea level are expected to change across Australia under future sea level rise increments (0.14m, 0.32m, 0.54m).

This analysis illustrates that every tenth of a degree of global warming is important. The climate risks facing Australia in a +1.2°C world versus a +1.5°C world are significant. For example, a +1.5°C world will see +22 days Marine heatwave duration compared to current levels of global warming. Further, a +3°C world has exponentially more significant impacts across a range of metrics, including +193 days Frequency of coastal flooding and +161 days Marine heatwave duration.

This is due to the cascading nature of climate change. Scientists expect that future changes in Australia’s climate will not occur gradually or smoothly. As global warming reaches potential climate and ecological tipping points, we are very likely to experience abrupt changes.

Looking ahead – Australia’s National Adaptation Plan

The NAP highlights the significance of adaptation actions, as opposed to the more frequently discussed, but equally important mitigation actions. It is clear that Australia faces a multitude of physical climate risks, that will continue to increase in severity and/or frequency as the climate continues to warm, despite efforts to mitigate greenhouse gas emissions. As such, adapting to a rapidly changing climate is now a national priority.

“The National Adaptation Plan represents a step change in the Australian Government’s response to climate change. It establishes, for the first time, a framework for adapting to the physical climate risks that are nationally significant within Australia’s Exclusive Economic Zone and external territories” (DCCEEW, 2025)

Building on the NCRA, the Department of Climate Change, Energy, the Environment and Water (DCCEEW) have published Australia’s first NAP. This NAP responds to the findings of the NCRA. It outlines how the Australian Government will fulfil its national leadership role, complementing plans prepared by other jurisdictions and sectors.

The NAP identified that overall, there is an adaptation action shortfall across all systems, risks, jurisdictions, and geographies in Australia. To support the NAP, the Australian Government committed $354 million in new funding in the 2025–26 budget for adaptation measures and $632.5 million over the medium term on measures relating to adapting to climate change and improving climate and disaster resilience.

Looking ahead, we are likely to see further clarity regarding roles and responsibilities for national climate adaptation, along with additional regulatory and policy changes resulting from both the NCRA and the NAP.

FURTHER INFORMATION

If you wish to discuss any of the information included in this Sustainability Reporting Alert, please get in touch with your local Grant Thornton Australia contact or a member of the Sustainability Reporting Advisory team at sustainability.reporting@au.gt.com.